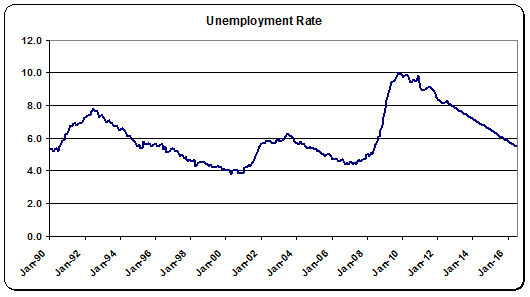

The Wall Street Journal reported on an important speech from Minneapolis Fed President Narayana Kocherlakota. He said rates should stay low until unemployment is at 5.5%:

“NEW YORK–A Federal Reserve official on Thursday proposed that as long as inflation remains in check, the central bank should not raise rates until there has been a very substantial fall in unemployment.

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota described a monetary-policy regime that would potentially leave short-term rates at effectively zero percent for years to come, most likely longer than the mid-2015 date central bankers currently suggest could bring the first increase in interest rates.

“As long as the FOMC is continuing to satisfy its price stability mandate, it should keep the Fed funds rate extraordinarily low until the unemployment rate has fallen below 5.5%,” Mr. Kocherlakota said.”

What does that mean for interest rates? Well, it means the Fed’s current prediction of keeping rates low til 2015 might be optimistic. Using a simple trend analysis during this recovery we shouldn’t expect unemployment to hit 5.5% until mid-2016. That’s assuming that things don’t pick-up, of course or that we don’t experience a bump between now and then (which would make this an extremely long period between recessions). So get used to ZIRP. It’s here to stay. Whether Kocherlakota is right or wrong.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.