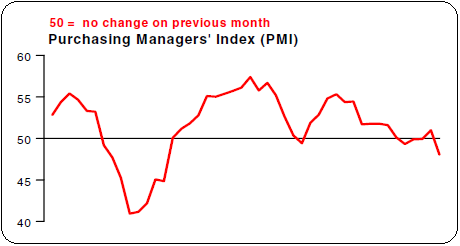

And the hits just keep on coming. Tonight’s Flash PMI report from China shows the economy moving into contraction range. HSBC’s report came in at 48 (anything under 50 is deemed contraction). As I’ve stated on many occasions, this is potentially the most worrisome trend in the global economy. While the weakness in Europe and the USA are both well known, no one is fully expecting a hard landing in China. This certainly increases the odds. HSBC has more details:

The HSBC Flash China Manufacturing Purchasing Managers’ Index™ (PMI™) is published on a monthly basis approximately one week before final PMI data are released, making the HSBC PMI the earliest available indicator of manufacturing sector operating conditions in China. The estimate is typically based on approximately 85%–90% of total PMI survey responses each month and is designed to provide an accurate indication of the final PMI data.

Commenting on the Flash China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:

“The dipping headline manufacturing PMI implies that IP growth is likely to slow further to 11-12% y-o-y in the coming months, as domestic demand cools and external demand is set to weaken despite the still resilient new export orders. That said, as inflation is likely to decelerate at a faster than expected pace, it will leave more room for Beijing to step up selective easing measures, which should gradually filter through to keep China on track for a soft-landing.”

Source: HSBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.