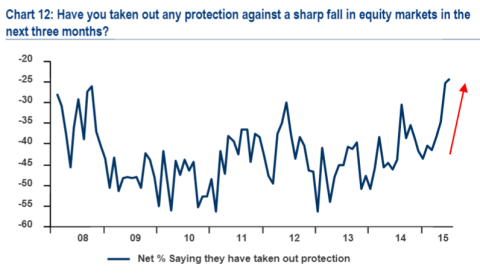

That Wall of Worry. Here’s a chart from the latest Merrill Lynch Fund Managers Survey showing the number of asset mangers who have taken out protection against their portfolio. The Greek “crisis” appears to have put the fear of Lehman into asset managers because we’re now seeing higher levels of protection than there was during 2008. Of course, this is a bit of a recurring theme in recent years. The so-called “wall of worry” has been high throughout the bull market thanks in large part to the scars of the financial crisis. Everyone is looking for the next crisis right around the corner. It will come at some point, but probably not when asset managers are all expecting it….

(Source: Merill Lynch)

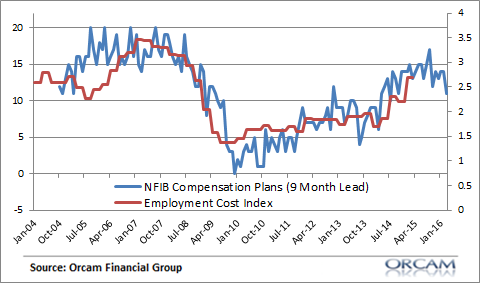

Maybe Wages Aren’t a Rising Risk? The latest NFIB survey showed a decline in the future expectations for compensation. This indicator tends to lead movements in broader indicators like the Employment Cost Index. And what we’re seeing now is flat wages going forward. It will be interesting to see how this plays into Fed policy in the coming quarters. My guess is that a rate hike is off the table until Q4 at the earliest and Q1 2016 is much more likely. But if this indicator is right then it might be even later than that….

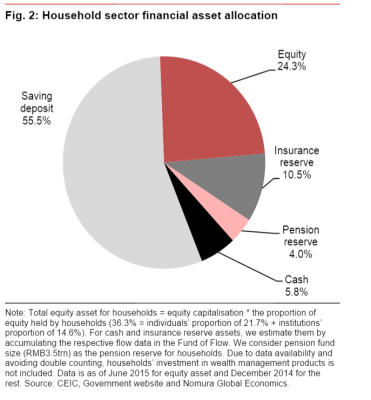

There’s no Chinese Wealth Effect. There’s been a lot of chatter about the Chinese stock market crash in recent weeks. But Nomura had a good note out this week discussing why the crash might not impact the economy much. The main reason is that Chinese households just don’t hold much in stocks. In fact, they hold an enormous amount in savings. The stock market represents just 24% of their financial assets. Not an insignificant amount, but when we consider that real estate accounts for the vast majority of non-financial assets it’s safe to say that the stock market isn’t a large enough component of household balance sheets to make a huge difference.

In addition, we already knew that the stock market “wealth effect” just isn’t that substantial as Robert Shiller has shown us. It’s much more impactful on the real estate side because real estate comprises a larger component of the household balance sheet and is often times linked to so many other components of the economy. So, just like the Chinese stock boom didn’t spark a big uptick in Chinese growth last year, maybe the downturn won’t spark a big downturn either.

(Source: Nomura)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.