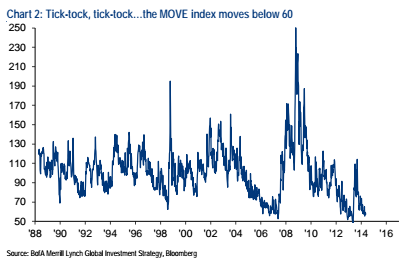

Just passing along an interesting chart and note from a Merrill Lynch research piece today. They cite the extremely low level of volaility. No, not the volatility level in the widely cited VIX, but the volatility in the US Treasury market. According to them, the market has traded at current levels just 4% of the time over the last 25 years:

“Today’s bear market is in volatility. The VIX index of stock market volatility has been nestled between 12 and 20 since the beginning of 2013. FX strategist Athanasios Vamvakidis notes that currency volatility is lower today than before the Great Financial Crisis (Link to Report). And the MOVE index of US Treasury volatility has dropped below 60, a level under which the index has traded less than 4% of the time in the past 25 years (Chart 2).”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.