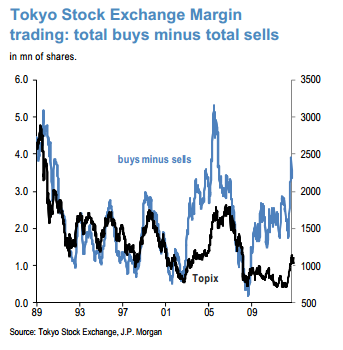

Here’s a great chart from JP Morgan research showing Tokyo Stock Exchange Margin trading versus the TOPIX Index (see below).

One subject I’ve discussed in detail recently is the concept of disaggregation of credit. That is the idea that credit can be used for both productive and purely speculative (often unproductive) uses. It is my contention that our increasingly asset based policy approaches (thanks to obsessions with policies like QE) have had a huge influence on borrowing trends in speculative markets. This has contributed to increased volatility in asset prices and negatively influenced economic stability. I think the housing bubble was at least partially caused by a disaggregation of credit (or at least exacerbated by it).

So it’s particularly interesting to see this asset price targeting on full display in Japan and what’s going on in the margin accounts at the Tokyo Stock Exchange. As you can see, the use of margin debt has tended to coincide both with speculative booms and QE. In case you don’t know, QE was also enacted in Japan from 2001-2006 and you can see what happened below.

Now, some might say that correlation doesn’t imply causation. But I don’t know if that’s true in this case. Obviously, one borrows funds in order to be able to then enact a trade. So the causation actually seems pretty clear with margin debt. And in asset markets speculative borrowers always end up unwinding their positions often by choice, but also by requirement. And it’s that required buying (like short covering) or forced liquidation that adds more volatility. It’s a sort of “what goes up must come down” effect that looks good on the way up and sucks the air out of the building on the way down.

Is that really a good thing for the economy? Is it something we should encourage and actively promote? I am inclined to argue no, but I guess that’s up for debate.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.