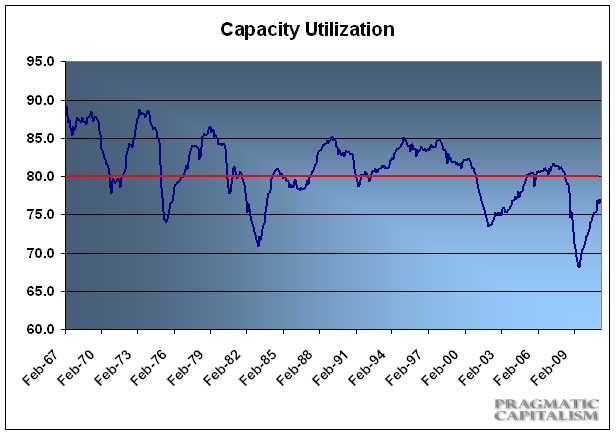

This morning’s reading on capacity utilization and industrial production shows that the recovery in the USA remains very weak. The Fed reports:

“Industrial production was unchanged in April after having increased 0.7 percent in March. Output in February is now estimated to have declined 0.3 percent; previously it was reported to have edged up 0.1 percent. In April, manufacturing production fell 0.4 percent after rising for nine consecutive months. Total motor vehicle assemblies dropped from an annual rate of 9.0 million units in March to 7.9 million units in April, mainly because of parts shortages that resulted from the earthquake in Japan. Excluding motor vehicles and parts, factory production rose 0.2 percent in April. The output of mines advanced 0.8 percent, while the output of utilities increased 1.7 percent. At 93.1 percent of its 2007 average, total industrial production was 5.0 percent above its year-earlier level. The rate of capacity utilization for total industry edged down 0.1 percentage point to 76.9 percent, a rate 3.5 percentage points below its average from 1972 to 2010.”

This is one of the better broad indications of economic growth. The lumpy growth in recent months is consistent with much of the weak data we’ve been seeing lately. Historically, the 80% level has signaled a healthy and robust economy. And while a quick glance at the historical data might show that we’re not far from that level, we’re actually closer to past recession lows than the 80% range.

This isn’t your average recovery….It’s built upon a much weaker foundation where the balance sheet recession lurks. If these cries for austerity take hold in the coming years and we convince ourselves that we are Greece we are going to be having a conversation almost as bad – the one comparing us to Japan.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.