If we look at “the market” of financial assets from the 30,000 foot perspective then an obvious reality becomes clear – there is actually ONE portfolio of all outstanding financial assets. And that portfolio generates its return every year and the holders of those assets will generate a return that reflects this top line nominal figure. The real, real return (the return that goes into our pocket) is this nominal figure minus inflation, fees, taxes and other frictions. In the aggregate we all fail to “beat the market” because we all represent the market.

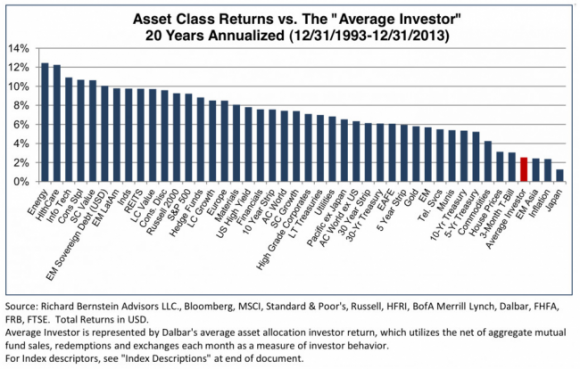

Of course, you can take that aggregate portfolio and slice it up into smaller segments or “markets” where certain people will generate better returns than others. Statistically, there will always be winners and losers every year. For instance, we know that many leading “passive” index fund advocates underperform the global financial asset portfolio over long periods. And we also know that many of these indexers outperform closet index funds like most mutual funds. But we also know that most individual investors are horrible investors. In fact, a recent study by Richard Bernstein showed that the average investor generated a measly 2.1% return over the period from 1993-2013:

That’s a truly frightening figure. It means that even if you had left your money invested with a high fee asset manager over this period you very likely beat the returns generated by most of your peers even though most high fee asset managers fail to beat “the market” or index funds. This goes to show that one of the most important decisions is just “getting in the game”. Of course, when one persons gets “into” the game of higher yielding instruments someone else is also “getting out” of that game. There is a buyer for every seller. So, by definition, we have to take the aggregate return of all financial assets. But when we think about personal benchmarks then “the market” is actually a pretty impossible benchmark to beat because we can’t all own stocks (widely thought of as “the market”) and we can’t all generate the aggregate market return of all outstanding financial assets. Therefore, trying to “beat the market” is truly a loser’s game.

It gets even more interesting when you think of how most of us benchmark ourselves. Since most of us (incorrectly) think of the “the market” as the S&P 500 we end up constructing an impossibly high benchmark for our personal portfolios. If you were to draw the distribution of asset class returns as shown above you’d quickly conclude that the S&P 500 generates a return that is far from the mean return. Subtract taxes and fees from that mean return and you likely arrive at a figure pretty close to that average investor figure of 2.1%. In other words, when we look at the aggregate markets the S&P 500 is a totally inappropriate benchmark for all of us. Most of us are setting ourselves up for failure before we even begin. Mathematically speaking, it is an impossible benchmark for all of us to strive for.

Instead, if you can beat the average retail investor, beat inflation, generate returns that don’t expose your savings to high risk of permanent loss and do so with moderate risk adjusted returns then you’re doing better than the vast majority of people. But most people can’t resist the urge to compare themselves to the S&P 500 and chase returns. And in doing so we don’t just chase returns, but we chase risk which often leads to instability in our savings. This impossible mission to “beat the market” will often lead to financial hardship due to excessive risk taking, high fees and higher taxes. After all, the secondary markets are highly competitive, don’t generate high aggregate returns (just about 5% for equities and 2% for bonds) and generally results in putting the cart before the horse (the stock market isn’t where you get “rich”).

Of course, this doesn’t mean you can’t make smarter decisions about how to allocate your assets over time that will generate results that leave you on the winning side of the return distribution more often than not and substantially improve that 2.1% figure. If we’re all ultimately asset pickers choosing certain asset allocations inside of the global aggregate portfolio then there have to be investors who engage in this process more intelligently than others. After all, if your choice of asset allocation is the primary driver of your future returns then those people who make smarter asset allocation decisions via a smarter process will ultimately beat the majority of their peers. This is due to the very real reality that there are deterministic reasons why some people are bad investors and others are not.

I am a big believer in the idea that you have to go into any endeavor with your eyes wide open. If you understand the field you’re engaging, understand the probabilistic outcomes and reduce the various frictions that will chew away at your returns then you can handily beat that 2.1% return that the average investor returns. Unfortunately, most of us don’t make the effort to understand the investing world well enough to avoid many of the pitfalls that lead to such terrible performance. And ironically, it’s the chase for performance that is so often the leading cause that chews into that top line figure thereby leading to sub-par returns. If more people tried to stop beating the market they’d almost certainly reduce their tax bill and fee structure thereby increasing the average real, real return. That is, we’d all do better in the aggregate if we stopped churning up our accounts so much trying to “beat the market”.

But there’s more to this – although beating the market is a loser’s game, there are smart active decisions that one must make in the process of allocating assets. And in my view, coming out on the right side is primarily the result of being well informed versus being poorly informed. Yes, it’s true – Jack Bogle was wrong when he said “nobody knows nothin”. Some people know quite a bit more than others and even the most basic understanding and acceptance of that reality will help lead you to better overall results. Yes, beating the market is often the wrong impossibly high measure to try to beat. But beating your peers is a very real possibility which can be done consistently if you have the right tools and understandings to do so.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.