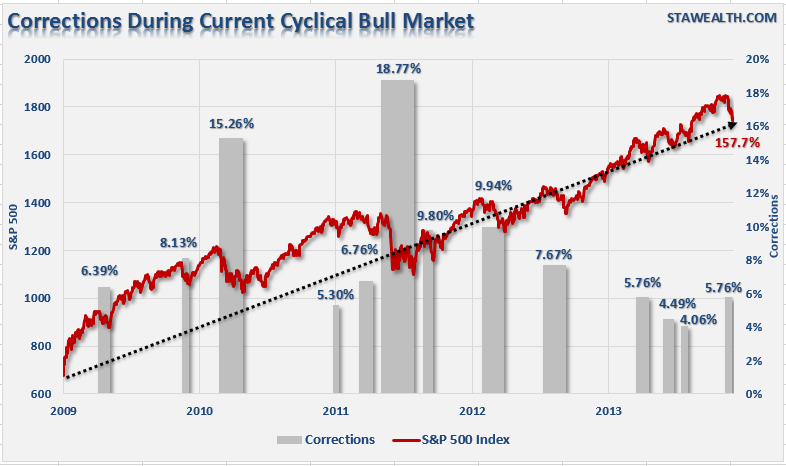

Just passing along a good chart from Lance Roberts which puts the various market corrections from the last 5 years in the right perspective: Cullen RocheMr. Roche is the Founder [ … ]

“Bad is Stronger than Good”

We humans are a fickle bunch. If there’s one thing you can pretty much guarantee, it’s that things are never really good enough. We seem to focus excessively on the [ … ]

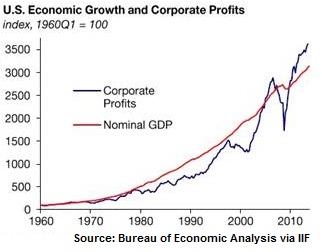

US Economic Growth and Corporate Profits

The U.S. has its own potential problem: corporate profits may be overshooting what growth….

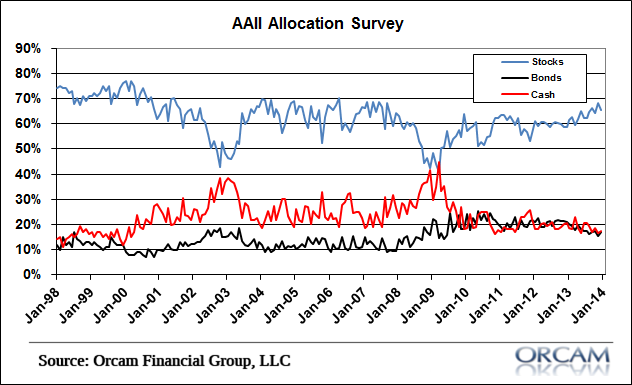

Individual Investors Back off Stocks in January

The latest AAII asset allocation survey showed a slight decline in bullishness about the equity markets. Stock holdings declined to 65.6%, down 2.7% from the previous month while bond and cash holdings were up 2.7%. The 65.6% allocation is shy of the highs seen in the late 90’s and much of the 2000’s, but still well above the historical average of 60%.

Today’s 4-1-1

Come get your cuatro uno uno.

8 Investing Lessons from Jeremy Grantham

Good letter here as always by Jeremy Grantham. This part sticks out with some good advice on investing:

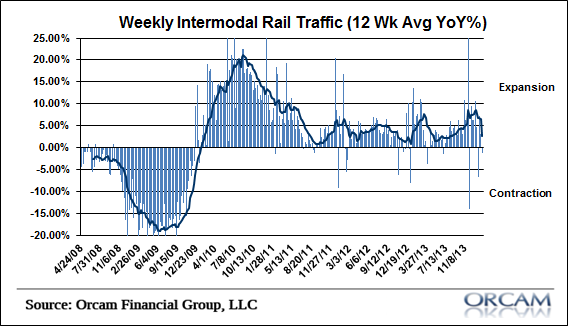

Rail Traffic Expansion Continues to Moderate

Rail traffic slowed a bit this week a negative weekly reading of -1.2%. This brings our 12 week moving average down to 5.8% from last week’s reading of 6.4%. The [ … ]

Debunking the Myth that a Gold Based Monetary System Leads to Higher Growth & Greater Stability

One of the most common arguments in favor of the gold standard is that the USA had very high rates of growth under a gold standard. The era that’s commonly cited is the 1800’s. The argument, in essence, is that gold is a more stable form of money that won’t lead to inflationary booms and busts. But this isn’t always presented in a very balanced manner.

Conventional Correlation between Stock and Bond Markets Returns

“Historically, rising equity prices have been associated with falling bond prices (rising bond yields), as stronger economic fundamentals drove investors to stocks and away from bonds, and weaker economic growth produced the reverse. However, over the past few years, equity and bond prices began moving together as both markets were inflated by floods of liquidity from accommodative U.S. monetary policy, which distorted the traditional relationship.