The release of yesterday’s Case Shiller housing index has some people talking about bubbles in housing again. In fact, Robert Shiller himself was on CNBC yesterday saying that he’s worried:

“I’m starting to worry about a bubble. In some cities it’s looking bubbly now,”

Of course, real estate is a very local thing. Shiller certainly knows that. He’s not saying all markets look bubbly. But he is saying some regions look bubbly:

“The really dramatic cities tend to be cities that had bubbles in the recent past – California, Phoenix, Vegas – It’s regional somewhat. The northeast is relatively mild.”

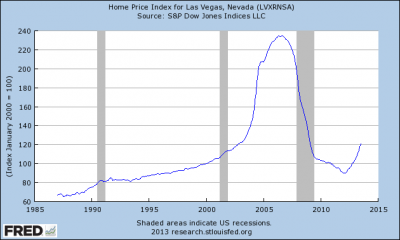

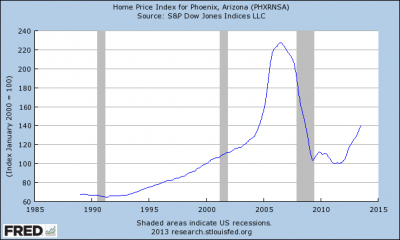

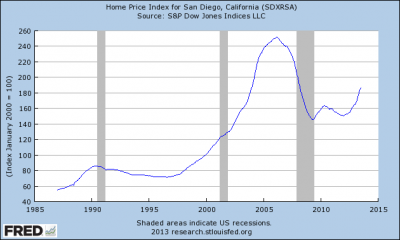

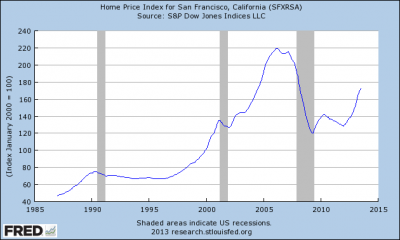

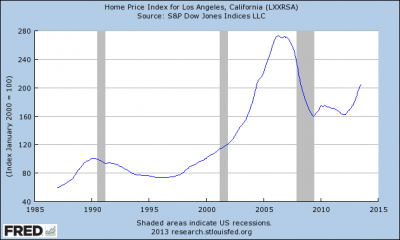

So let’s put that in perspective. The following charts are the big bubble cities. They include Vegas, Phoenix, San Diego, San Francisco and Los Angeles. These are cities where the price appreciation in the 2000’s was off the charts. Let’s take the 30,000 foot view of what’s happened over the long-term:

Las Vegas

Phoenix

San Diego

San Francisco

Los Angeles

Price changes vary quite a bit across these cities. Vegas, for instance, is still 48% off the highs while San Francisco is just 20% off the highs. You could get even more granular than that though. I know for a fact that the coastal regions of San Diego are almost all back to their bubble highs or very close. If you go further inland then the prices drop. So it varies. Obviously, the big money in California is on the coast so you have to be careful extrapolating too much out from coastal data.

In general, real estate markets are hot right now and I know I’ve never seen so much building and activity in the San Diego area as I do today. And if you list a home in a desirable area you better be prepared for a bidding war. We’ll see if that continues into the winter months. It usually doesn’t, but who knows. As Robert Shiller knows, those animal spirits often get the best of us. But San Diego and the other California cities appear to be outliers. After all, the national index is still down 20% from its peak after a 20% climb from the bottom in 2011.

In sum, I’d say there’s no bubble nationally and certainly no bubble in places like Vegas, Phoenix, but some of the California cities are starting to feel bubbly again, but not quite there yet. Stay tuned.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.