There’s been a lot of chatter in recent days (see Paul Krugman for instance) about the corporate cash hoard and how the economy would be humming if corporations were putting all this cash to work. The thinking is generally based on the understanding that corporate profits are soaring, but the corporations are just sitting on all this cash as if there’s nothing to do with it (Apple’s particularly healthy balance sheet gets the majority of the press coverage and scrutiny, but doesn’t provide nearly the full picture). But a different take explains why this might be occurring – maybe corporate America isn’t as well off as we all believe.

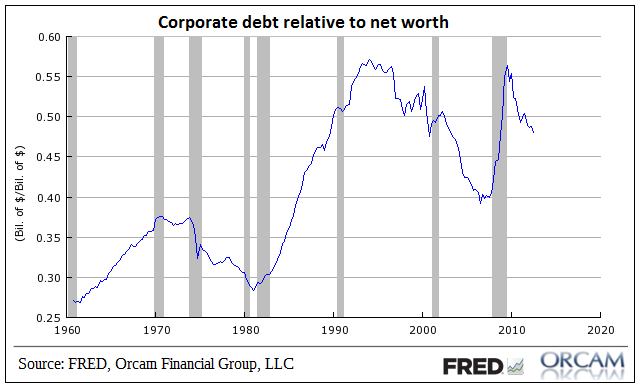

It’s true that corporate profits are booming, but that doesn’t put the full balance sheet into perspective. While corporate profits are booming, debt relative to corporate net worth is actually still very high. In fact, corporate debt relative to net worth is just shy of recent highs and still extremely high in terms of the last 50 years.

Now, this doesn’t mean corporations are necessarily so weak that they can’t spend and invest, but it does throw some cold water on the idea that corporate America is benefiting from the recent surge in profits and just refusing to contribute to the recovery.

The reality is that corporate America is more fragile than most believe and the lack of strong aggregate demand gives them good reason to be cautious about their balance sheets.

(Chart via Orcam Investment Research)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.