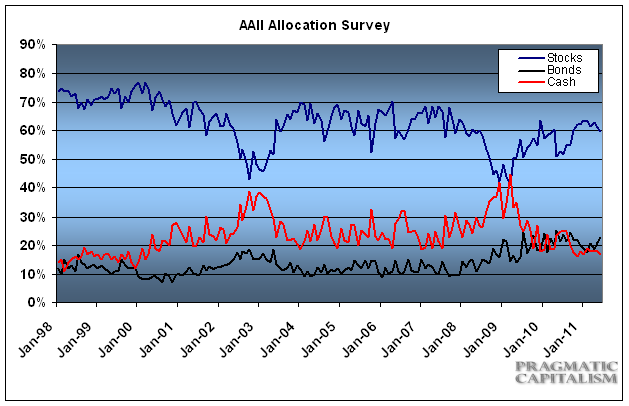

The fear in June was palpable. Debt ceilings, Greek default, economic slow-down, etc. Most of these fears were guaranteed to never materialize, but that didn’t stop the small investor from shying away from equities. According to the latest AAII allocation report small investors continued to shun stocks in favor of bonds and cash. Charles Rotblut of AAII details the report:

Stock allocations fell to a nine-month low last month, according to the June AAII Asset Allocation Survey. Individual investors held 59.5% of their portfolio dollars in stocks and stock funds, a 1.5 percentage point drop. This was the first time since September 2010 that equity allocations were below their historical average of 60%.

Bond allocations declined as well. AAII members reported that bonds and bond funds accounted for 19.0% of their portfolios, a 2.1 percentage point decrease from May. Even with the decline, June was the 25th consecutive month that fixed-income allocations were above their historical average of 15%.

Individual investors did increase their cash positions, however. AAII members reported allocating 21.5% of their portfolios to cash, the largest amount since August 2010. The historical average is 25%.

The decline in equity allocations occurred as investors were pessimistic about the six-month outlook for stock prices. Bearish sentiment hit 47.7% on June 9 in our weekly Sentiment Survey, the highest level of pessimism since August 26, 2010. Many individual investors have also expressed angst over the lack of agreement on the debt ceiling, and it is likely that this contributed to the decline in bond allocations. At the same time, individual investors continue to be concerned about the potential for higher interest rates (and thereby lower bond prices) in the future.

This month’s special question asked AAII members which regions or countries they would invest in if they were given new money to buy stocks. The most popular choices were, in order, China, North America, Central and South America, and Asia/Pacific Rim. Many AAII members listed Brazil,Canada, India and the U.S. as specific countries they would invest new dollars in.

June Asset Allocation Survey Results:

- Stocks Total: 59.5%, down 1.5 percentage points

- Bonds Total: 19.0%, down 2.1 percentage points

- Cash: 21. 5%, up 3.59 percentage points

Asset Allocation details:

- Stocks: 28.1%, up 1.0 percentage points

- Stock Funds: 31.5%, down 2.5 percentage points

- Bonds: 3.8%, down 0.7 percentage points

- Bond Funds: 15.2%, down 1.3 percentage points

Historical Averages

- Stocks/Stock Funds: 60%

- Bonds/Bond Funds: 15%

- Cash: 25%

(Chart provided by pragcap.com)

(Chart provided by pragcap.com)

Source: AAII

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.