I wanted to republish and elaborate on some thoughts I expressed in a previous comment regarding the flaw in QE’s expectational transmission mechanism. In case you’re unaware, a number of people have been pointing out how QE3 is “already working” just because some markets have responded favorably. I touched on this here, but it’s important to look into this in some more detail. Here’s what I said in the comments:

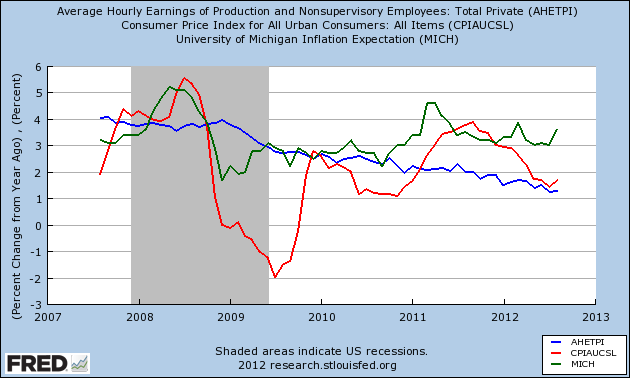

“Inflation expectations can rise in the near-term without a long-term follow-thru in wage inflation. It’s my belief that people tend to spend out of current/expected income. So, if inflation expectations rise then there will only be a follow-thru spending effect if wages actually rise as a result (or subsequently rise to sustain current spending). This can be seen best in this chart:

What you see is two big spikes in inflation in the last few years from QE1 and QE2. But what you also see is a persistent decline in wages. Ie, the spending power of consumers isn’t following through from the higher inflation expectations. The result is weak demand and a weak economy. Ie, QE worked in QE1 because we were in a deflationary spiral, but QE2 failed and QE3 is also likely to fail because it won’t result in a follow-thru in consumer spending because it lacks a transmission mechanism to cause a wage spike.”

We can see this a bit more clearly if we zoom in:

What we have here is inflation expectations in green, CPI in red and wages in blue. The chart starts in 2008 during the big oil spike that led everyone to think high inflation was inevitable. We all know what happened next. Then, in late 2008/2009 we had the QE1 announcement and the government bazookas were brought out. Inflation expectations rebounded in late 2008 and leveled off through QE1. I’d say QE1 was a success because we were in a deflationary death spiral and the Fed helped put a floor under the market. This was inflationary to the extent that it stopped the deflation from panning out. But the inflation didn’t make any meaningful lasting impact as we see in the red line’s clear decline into disinflation in 2010. But inflation expectations surged when QE2 was unveiled. And CPI rebounded briefly before it became clear that QE2 wasn’t causing the hyperinflation or even high inflation that many expected. More recently, we have a spike in inflation expectations following QE3.

But look at the one constant through all of this – declining wages. The impact of falling wages and the relationship with inflation is much clearer in figure 1, but the basic gist of the thinking here is that it doesn’t matter at all what near-term inflation expectations are if there isn’t a transmission mechanism for sustained translation of higher expected inflation into wage inflation which would be consistent with higher economic output and lower unemployment.

Instead, what we’re seeing is a glorious environment for corporations where they’re earning record profits, employees have no pricing power, margins are surging and the sagging demand from the weak consumer results in no urgency to boost wages or hire en masse. And so the problem with QE is that there is no transmission mechanism through which it sustains high inflation expectations which lead to sustained wage inflation. As Fed governor Evans said yesterday, fears of Fed-fueled inflation have been “consistently wrong.” That’s because the transmission mechanism to cause sustained inflation is very weak. Of course, the Fed isn’t just trying to generate inflation, but the environment they’re trying to create would certainly be consistent with higher inflation. So in the near-term markets fret about “money printing” and hope for lasting impacts from “wealth effects”, but the expectations consistently fade without any lasting impact….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.