The seven year bull market in stocks hasn’t been a story about how great things are. Let’s be honest – the economy is still pretty weak. But this bull market in stocks has been more about how wrong the bears have been. The thing is, stocks don’t rise just because the economy is getting better. They often rise just because the economy is getting better relative to expectations. And in the last few months a lot of people were predicting doom and gloom all over again, a story we’ve heard once every few quarters for 7 years straight. For a brief moment there it actually looked like China might suck us all down the drain with it. But it turns out that China might not be as bad off as some people think and China certainly isn’t pulling the US economy down with it. It still hasn’t been a very good year in the markets, but it hasn’t turned out nearly as bad as many might have expected back during the summer.

What we had early this summer was an environment in which a lot of people were convinced that 2008 was occurring all over again and sold, sold, sold. Meanwhile, the macro data in the USA wasn’t really changing all that much. Yes, many multinationals are seeing hits to their earnings thanks to weak foreign sales and the rising dollar, but much of this is an energy story. While blended earnings are down 2.2% year over year, the exclusion of energy from the S&P 500 results in a 5% increase in year over year earnings. And the energy story is hardly surprising to anyone at this point. It was priced into energy stocks as oil prices cratered last year.

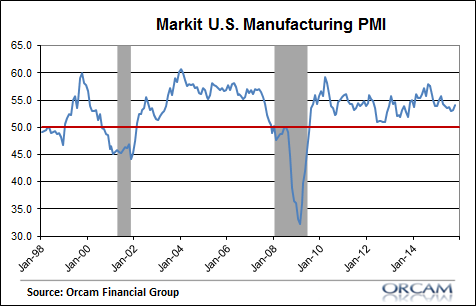

At the macro level the story is just more of the same weak economic recovery. The latest PMI reading was a 6 month high, but not great:

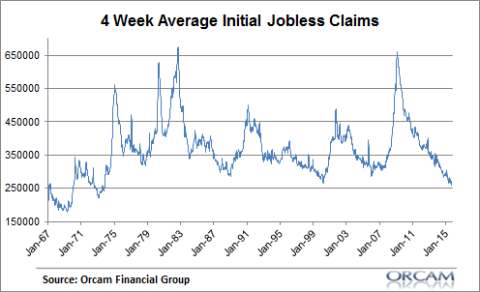

The recent readings on jobless claims continue to hit lows while job growth remains somewhat tepid:

Industrial production is just shy of all-time highs, corporate profits are just shy of all-time highs, etc. I could go on and on. But the bigger point is that expectations of a 2008 repeat got way too high over the summer. And now that it’s become clear that the economy isn’t doing as poorly as many expected US stocks have come back in a big way. As I noted repeatedly over the last few months, it just didn’t look like much was changing in the US economy that warranted the kind of fear we were seeing in the stock market. In fact, I kept saying this environment looks a lot more like 1998 than 2008 when stocks went through a brief emerging market scare and then got spring loaded into the big stock bubble that ultimately ended the 90’s bull run.

But this bull market is still a story about how the bears have been wrong more than how the bulls have been right. After all, it’s been a pretty crummy economic recovery. And the consistent fear of a 2008 repeat has created this massive wall of worry that has buyers scrambling for fear of missing out. The recent market action in October wasn’t a change in the macro story. It was the result of another brief scare in what has been nothing more than a long running costly narrative about how the next 2008 is right around the corner….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.