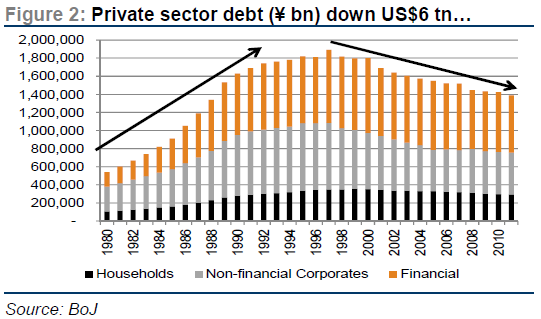

Credit Suisse has published a nice note on the balance sheet recession and Japan’s de-leveraging cycle. Japan has undergone one of the most crushing de-leveraging cycles in history due to simultaneous asset bubbles in equities and real estate and an extremely misguided policy response. The result has been a 20 year malaise that has knocked the Japanese economy down to the world’s fourth largest. The good news according to Credit Suisse is that the balance sheet recession in Japan is finally ending:

“Unlike the US, UK or Eurozone, Japan’s corporate sector over the last 20 years faced a daunting prospect of having to de-leverage against the backdrop of deflation and flat nominal GDP. In our view, the Japanese corporates have performed a near “miracle” of reducing US$6 tn of debt without help from growing economy and despite the reluctance of BoJ to embrace a more aggressive monetary policy. It seems there is growing evidence that after 20 years, the Japanese corporate sector is finally “healing”. We focus on three signs: (1) the corporate sector is no longer reducing debts or increasing cash; (2) private investment is no longer declining; and (3) ROE and ROIC are gradually recovering (though from depressed levels). At the same time, Japan’s labour productivity growth rates continue to offset the poor demographics, while competitiveness, innovation and complexity indices remain strong. It seems likely that the corporate sector could surprise on the upside.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.