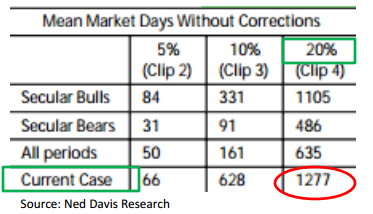

Just passing long an interesting data point via Ice Cap Asset Management. They highlight the fact that we’re getting pretty long in the tooth for secular bull markets that haven’t experienced a 20% correction:

“Today it is fact that we haven’t seen a 20% market correction in the US market for a very long time – 1,277 days to be exact.

While a 20% market decline may sound rather harsh, it actually happens more frequently than you’d think. During Secular Bull Markets, we usually see 1,105 days before the dreaded 20% decline. Whereas Secular Bear Markets only manage on average 486 days before the 20% tumble hits.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.