I’ve bucked the recession calls now for a long while, but I see new recession calls becoming increasingly popular. In a recent update Mike Shedlock offered 12 reasons why economic optimism is unfounded. He says:

- Europe is a disaster.

- US manufacturing is cooling rapidly

- China is cooling rapidly: China Manufacturing PMI 7-Month Low, Sharpest Decline in New Export Orders Since March 2009

- US Monetary policy is at best useless, but more likely net harmful, especially to those on fixed income.

- First year presidential politics are frequently recessionary

- US still needs fiscal tightening

- Unemployment insurance has expired for millions: 200,000 Lose Unemployment Benefits This Week, Nearly Half From California

- Self-Employment desperation: 100% of U.S. Jobs Added Since 2010 Have Been Self-Employment, Contractor, or Other Jobs Without Unemployment Insurance Benefits

- Last two jobs reports have been dismal: Another Payroll Disaster: Jobs +69,000, Employment Rate +.1 to 8.2%, April Jobs Revised Lower to +77,000; Long-term Unemployment +310,000

- The 4-week moving average of weekly unemployment claims is at the highest rate of the year, at 386,250.

- New home sales cannot gain significant traction: New Home Sales Hype vs. Reality

- Tax Armageddon

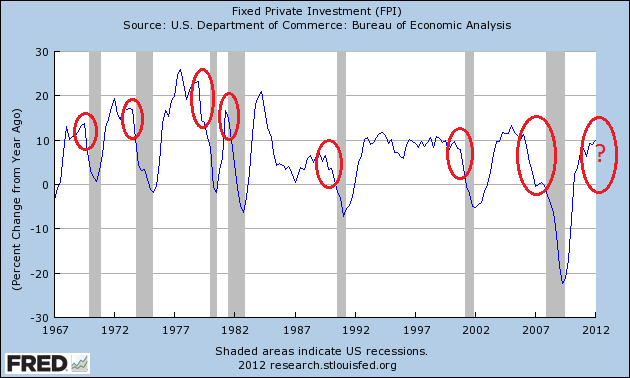

I’m still bucking the negativity trend for now and I’ll give you one big reason why. My expansion/contraction model has been right on the money for the last 12 months as many of these recession calls have become more pronounced (maybe my time for being wrong is overdue though!). One of the more glaring non-recessionary components of my model is a big one – fixed private investment. In the last 45 years ALL SEVEN recessions have been led by a decline in fixed private investment. The only close call was the 82 recession which was really a double dip.

The Q1 2012 reading was 10% year over year. So if we’re in a recession or on the verge of a recession then fixed private investment must be cratering as we speak. That, or it’s “different this time”. And while I hesitate to say that it can’t be different this time, we have to recognize that economic forecasting is largely a game of playing the odds and the odds of a recession with fix private investment at 10% is extremely low. I think recession is much more likely in 2013 as the fiscal cliff comes to fruition.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.