Bonds have always struck me as fairly simple instruments. In general, you know what a (high quality) bond’s return will be and you know what its time horizon is. That makes investing in fixed income instruments much simpler than investing in stocks. After all, the most difficult part about the stock market is that you don’t know the future returns OR the time horizon. This uncertainty is what makes the stock market unnerving and disruptive to good portfolio management.

But this distinction between “stocks” and “bonds” might be more blurred than it needs to be. In fact, I find this across most financial instruments. Terms like “money”, “cash” and “bonds” are designed to create specific distinctions, however, they can cause an equal amount of confusion since the lines between these various instruments are often blurred.¹ As a result I generally like to think of all of these instruments simply as varying types of financial instruments with some characteristics that overlap. In other words, financial instruments exist on a spectrum rather than in neat little buckets. This can be extremely helpful for the process of financial planning as it helps us construct a useful asset/liability matching approach.

So, how do we solve for the problem of time and return in the stock market so that we can make the stock market a more predictable instrument in our portfolios like bonds? In my new(ish) paper on portfolio construction I ran a simple heuristic technique to put an approximate duration on the stock market. This calculation came out to about 25 years which I believe is a good general starting point for the stock market. Okay, so let’s think about the stock market as having at least a multi decade duration. It’s basically a super long duration bond.

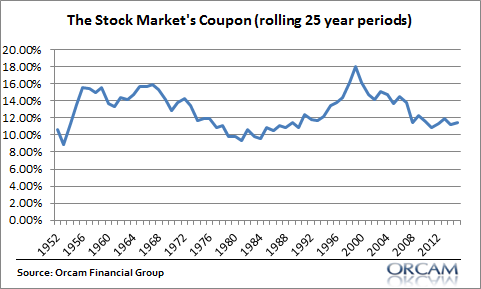

What about return? We know that the stock market has averaged an annual return of about 11.5%. And if we apply our 25 year time period to the stock market then the rolling coupon of the S&P 500 actually begins to look quite stable:

When viewed through this lens the stock market looks like a corporate liability that has a high credit quality, a very long time horizon and a high coupon. It’s kind of like a high quality high yield bond. Of course, the tricky part is putting this in the right context relative to your overall portfolio because the stock market doesn’t generate anything close to stable returns in the near term and we can’t expect past returns to be predictive of future returns.² Most of us don’t have a rolling consistent 25 year investing time horizon or the risk tolerance to undergo the annual volatility of the stock market. As a result, owning this instrument can be unnverving as it creates a huge amount of short-term uncertainty. But within the right context, thinking of the stock market like a long duration bond has many advantages:

- Defining the time horizon of the stock market helps overcome short-termism and behavioral biases in the stock market. While we are constantly barraged with the idea that the stock market is something we should judge on a daily, monthly or annual basis this perspective shows that it’s highly irrational to judge the stock market on anything less than a multi-decade time period.

- This temporal definition puts the declines of the stock in the proper perspective and makes them much more palatable. In much the same way that a bond can boom and bust across its lifetime, its fixed time horizon and yield create great certainty around these ups and downs. The stock market, having a fairly reliable 25 year rolling coupon, helps put these market gyrations into perspective and explains why, after periods of low returns, the stock market tends to perform well (reverting to its historical coupon) and vice versa.

- Understanding the riskiness of the stock market’s short-term movements helps us to construct a proper risk profile and asset allocation relative to our other safer assets. The only way to reduce the riskiness of the stock market is to hedge it with instruments that will buffer or counterbalance its volatility. Finding the right mix of assets with the right durations is the key to constructing a portfolio that matches the right assets with the right multi-temporal needs.

Although it’s inappropriate to refer to stock and bonds as the same types of instruments it can be useful to throw out this distinction and think of them more along the lines of being instruments with important differences, but also similarities. And when we can define stocks in a manner that helps relate them to bonds we establish a higher probability of financial success as we more accurately define our risk profiles relative to these assets as well as placing these instruments within the proper temporal horizons.

¹ – As an overly simplistic example here, consider that a money market fund is essentially comprised of things like T-Bills, however, a money market fund is considered “cash” by most definitions. But at what point does a T-Bill or T-Note become cash vs a bond? The line there is rather blurred in reality….

² – This heuristic is not a future return prediction. It is merely a temporal heuristic to help an investor place the stock market in the correct temporal bucket so they can set realistic expectations and better manage behavior across an appropriate time horizon.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.