Active managers want you to think index funds are bad because they’re losing tons of money to low cost strategies. And as this trend gains momentum we’re seeing an increasing number of articles and research claiming that index funds are somehow bad. The latest one, this article in the Atlantic, wants you to think that index funds are causing monopolistic tendencies that lead to higher consumer prices. Let’s explore this thinking a bit more.

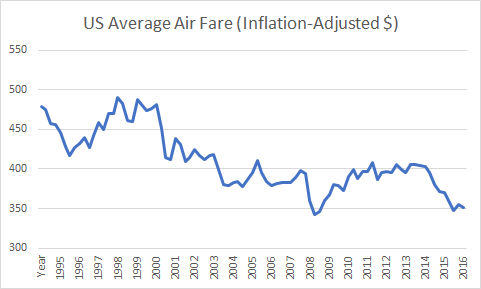

I’ve written about this general topic (that index funds are hurting the economy) a number of times in the past (see here and here), but I want to focus specifically on this idea that prices are rising because of index funds. First, there was a widely cited study by Azar, Schmalz & Tecu claiming that airlines with high amounts of index ownership tend to result in price collusion and less competition. There seems to be a major fallacy of composition occurring here though. Inflation adjusted airline fares aren’t rising even though indexing is booming. In fact, real airline fares have fallen in the last 20 years (via the BTS):

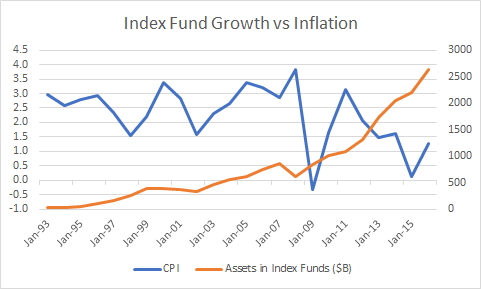

Second, this data is also consistent with broader inflation trends. Although indexing has increased astronomically in the last 20 years there has been a consistent decline in the rate of inflation. Said differently, there is little macro evidence that consumer prices are being impacted significantly by the rise of indexing. In fact, it appears as though corporations are not seeing enough aggregate demand and hence are not able to raise prices as much as they might want.

But I would argue that this argument is even more fundamentally incorrect. Investors who buy index funds are specifically buying funds that do not exert their influence over corporations. The index fund shareholders do not believe that active investors can successfully influence or pick the best performing companies. As a result, the index fund is an extension of this belief and is therefore unlikely to try to directly influence or manipulate prices by imposing its influence on firms. Instead, I would argue that the idea that index funds can create collusion is exactly backwards. I would argue that index funds create greater disaggregation between secondary market shareholders and corporate actions by incorporating a less activist shareholder impact. This view is not only more consistent with the fundamental beliefs of the index funds and their shareholders, but also appears to be consistent with the aggregate price data we see.

I think we have to start being very stern about this myth that indexing is bad for the economy. The active managers want their fees back and they will slowly but surely try to convince Congress that this growing trend is bad for Americans. Ironically, this is nothing more than active managers trying to exert their monopoly-like influence on lobbying to raise the prices we will all pay for owning financial assets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.