A number of finance and economic writers have come out rationalizing Pete Carroll’s controversial play call in the Super Bowl which ended up being intercepted by the Patriots and leading to the [ … ]

Category: Behavioral Finance

Playing the Optimal Game Requires an Optimal Understanding

I used to gamble quite a bit. Not because I enjoyed losing money, but mainly because I was convinced that I understood the games better than most. I don’t know [ … ]

Economics is a Social Science, not a Natural Science

Economics is categorized as a “social science” alongside anthropology, psychology and sociology. Which makes complete sense considering that economics studies the relationships that dictate how we produce and consume goods [ … ]

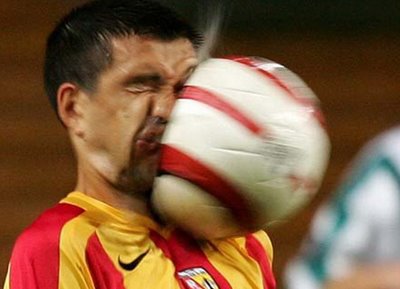

Off Topic – Let’s Talk About Sports

It’s Friday, the markets are rising (what else is new) and there’s not a lot of interesting things to talk about so let’s talk about something else – sports.

Second Level Thinking – World Cup Edition

Jurgen Klinsmann, the coach of the US soccer team is caught in a maelstrom after deciding to leave Landon Donovan, the leading goal scorer in US Men’s National Team history off the team. But I don’t think he’s getting enough credit for the brilliance behind the move. And to me, it looks like a smart case of second level thinking.

Still Buying the (Golden) American Dream…

This recent Gallup survey on expected future returns of asset prices is pretty interesting. It shows that most Americans still think that owning a home is the best way to generate a high return in the future:

Thinking About Price Compression

In my view, “risk management” is largely about understanding the big picture so you can better decipher the world.

The End of Behavioral Finance?

I don’t know what it will take for more people to take behavioral finance seriously and assimilate it into their work, but I do think that day is coming. Here’s to hoping it doesn’t take another 2008 style slap upside our economic head to get us there.

“Bad is Stronger than Good”

We humans are a fickle bunch. If there’s one thing you can pretty much guarantee, it’s that things are never really good enough. We seem to focus excessively on the [ … ]