Here are some things I think I am thinking about:

1. Here’s Something Weird For Ya….So there’s this story going around this week about “Incels”. I had never heard of the term before, but apparently it describes a male who is “involuntarily celibate”. And apparently they argue that their celibacy is sex inequality and is contributing to male mental health problems that can lead them to kill people like the mass shooting in Canada last month.

So…an economist at George Mason went into some detail arguing that income inequality was somehow similar to sex inequality and that maybe we need to start paying more attention to that problem as well. And then some serious people, like Ross Douthat of the NY Times started giving this argument some credibility because income inequality is a huge problem these days.

This is all super weird. You see, an income is a necessity in our world. Our monetary system requires everyone to have an income to be able to survive. No income and you could literally starve to death. So yes, income inequality is a serious problem. Sex, on the other hand, is not a necessity. I know, I know – we want it, but no one really needs it to survive.¹ So you want an income and you need it to survive. And you want sex and don’t need it to survive. So the comparison is a total non-starter.

Now, this does all touch on a whole different problem – the economic crisis that is occurring in the male population. More and more young men are having trouble finding an identity in a quickly changing world. Sex inequality, or whatever we want to call it, is certainly a symptom, but let’s not start confusing it for the cause.

Okay, I need to go take a shower after writing about that. I’ll be right back.

2. Oh Elon….So, back in another life I ran a small investment partnership that had pretty big returns. That partnership relied on an event driven strategy where I basically gamed analyst earnings estimates. I was really good at it, but it was a ton of work. A lot of that work involved listening to earnings calls. Thousands upon thousands of earnings calls.

Now, earnings calls are pretty interesting when you know what to listen for. You need to know each relationship on the call and that takes time, but you begin to see the same dynamics across successful companies. Basically, they know the analysts, the analysts know management and there’s a give and take at work. And the really good management teams know how to play coy with the analysts so they set their estimates the way management wants. But there’s also always a certain rapport with the best management teams – they fully understand how the game works and they’re 100% happy to play that game. And you begin to recognize it after a while:

[Homer, at Simpson Partners]: “Hi guys. Great quarter. You are really firing on all cylinders.”

[Mr. Burns, CEO of Springfield Nuclear]: “Mmm. Thank you Homer. It’s so nice to talk to you again. We’re doing okay, but we’re not yet firing on all cylinders.”

Of course, the purpose of conference calls is to be fully transparent. The required quarterly 10-Q can be boilerplate nonsense or really opaque in many cases. It’s extremely helpful to be able to get on a call and tell your shareholders why certain things happened. It’s just good business to be transparent to the people who own the company you’re managing.

So that brings us to the Elon Musk saga from a few days ago when he shut down the analysts on his call and called their questions “boneheaded”. Back in my day this would have been a humongous red flag. It’s not only a disturbing lack of transparency, but it’s the kind of rapport you only see when things aren’t going great and management knows that the analysts know they’re not going great.

Of course, I got out of the stock picking game a long time ago and I certainly don’t understand Tesla well enough to have an opinion on the stock, but we should be really clear that the beauty of public markets is that companies like Tesla are owned by the public and conference calls and quarterly earnings reports are part of the process by which these companies open their books and provide the transparency that makes our markets work. And yes, part of that process involves answering “bonehead” questions. After all, it is banal and boring questions that often tell us the most interesting things about a corporation and the people running it….

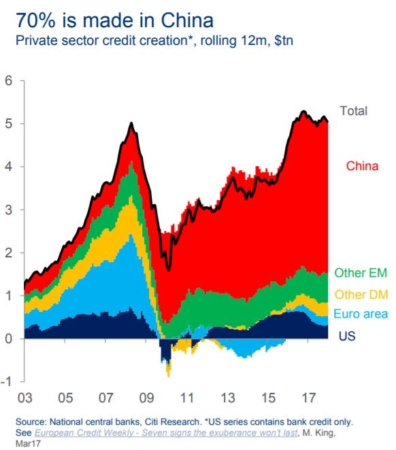

3. When China Sneezes....It used to be that when the USA sneezes the world catches a cold. And that’s still probably true to a large degree because our public markets and economy are still so large. But I feel like that’s changing. In 50 years I suspect we will all be waiting to see if China sneezes.

I know, I know – people used to say the same thing about Japan when they were booming. But there’s a big difference here – China has a growing population (that’s 12X the size of Japan’s) and a booming middle class whereas Japan has a shrinking population and a stagnating middle class. And where do we see these trends most apparent? Debt.

Take a look at the growth in private sector debt since the crisis:

That’s bigly. So, keep a close eye on those Chinese housing prices. If and when they turn south it could mean the rest of us are about to catch a cold….

1 – I know what you’re thinking so back off you perverts. The point I am making is that you aren’t literally going to die from a lack of sex. Yeah, I know sometimes it feels like that, but really, you’re not going to die from it.²

² – [Takes second shower]

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.