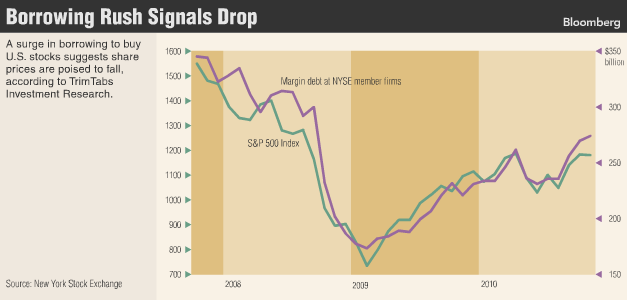

With an overly financialized economy addicted to debt it’s only appropriate that the equity markets would be fueled by rising debt levels. According to Bloomberg margin debt is rising at a pace that is consistent with near-term market peaks:

“Borrowing to buy U.S. stocks is rising at a pace that suggests investors are too exuberant and share prices are poised to fall, according to Charles Biderman, chief executive officer of TrimTabs Investment Research.

The CHART OF THE DAY shows how the total amount of margin debt, or loans for stock purchases, provided by New York Stock Exchange member firms compares with the Standard & Poor’s 500 Index since a five-year bull market ended in October 2007.

Margin debt climbed by $38.2 billion in September through November, according to data from the NYSE. The increase was the biggest in a three-month period since May-July 2007. November’s $274 billion total, released last week, was the highest since Lehman Brothers Holdings Inc. collapsed more than two years ago.”

While this data may be pointing to excessive near-term exuberance it also has long-term implications as debt levels remain well below market peak levels. This reduced risk tolerance is consistent with the general economic malaise we have experienced over the last 36 months. A continued rise in economic activity, sentiment and margin debt could ultimately prove to be a net positive for the equity markets. The takeaway here is a rise in near-term risks, but a potential fuel for long-term market gains.

Source: Bloomberg

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.