If you’re worried about high inflation then you must definitely think that the markets have things all wrong.

Category: Chart Of The Day

(Just Charts)

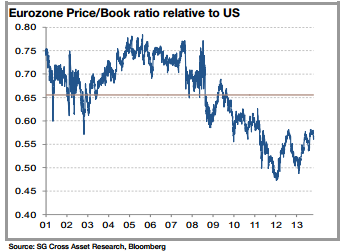

SocGen: 2 Reasons to be Bullish About Peripheral Europe

Here’s a contrarian view for you:

What a Repeat of 2009 Would Look Like

Nothing too exciting here, but I thought this chart from MarketWatch was pretty a pretty interesting perspective of some historical bull/bear markets. It shows how some historical precedents might play out:

Chart of the Day: Both Sides of the Ledger

One of the most important things you learn when you start to think of the world in a macro way is that you start looking at both sides of the ledger before making sweeping conclusions. This helps you to avoid falling victim to a fallacy of composition.

Rail Traffic is Starting to Soften

The latest reading on rail traffic is showing some fairly substantial softening. The weekly reading in intermodal traffic came in at -5.7% which brings the 12 week moving average to just 1.7%. That’s the weakest reading since the middle of last year. On the whole, this is much more consistent with the muddle through economic environment we’ve been seeing.

Charts O’ the Day: Emerging Markets on Sale?

Here’s some macro perspective for you. Yesterday, Barclay’s strategists published some good insights putting the recent underperformance of emerging markets in perspective. Value investors and macro investors alike might find some useful info here….

Chart ‘O the Day: Let’s Stop with the 1929 Comparisons, Okay?

This is not 1929. So let’s stop with that, okay?

Corrections During the Current Cyclical Bull Market

Just passing along a good chart from Lance Roberts which puts the various market corrections from the last 5 years in the right perspective: Cullen RocheMr. Roche is the Founder [ … ]

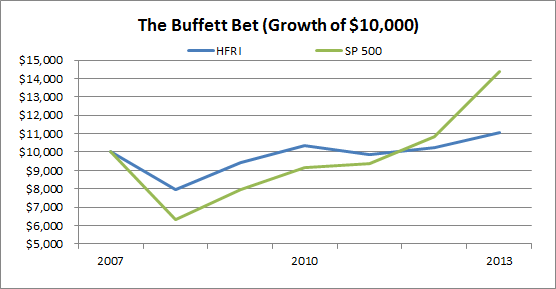

Buffett’s Index Fund Bet is Sitting Pretty

Buffett’s index fund bet against a group of hedge funds is looking pretty smart. Especially when one considers the terms of the agreement, which make the hedge funds look even sillier….