4 Things you should read:

- What if preferences are unstable? – Noah Smith

- Jan Hatzius discusses the rationale for tapering – CNBC (video, which is sort of like reading)

- Hoisington Investment Management Quarterly Review – Value Walk

- Wall Street’s new housing bonanza – NY Times

1 Data Summary:

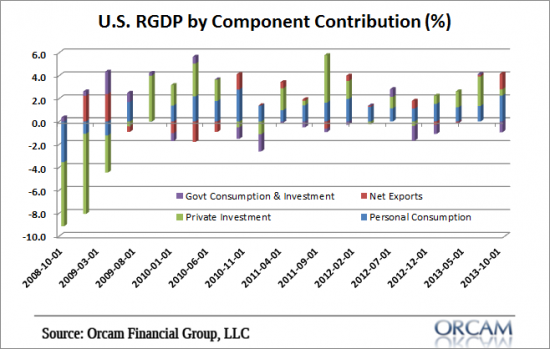

- Q4 real GDP came in at 3.2% which was better than expectations of 3%. Final sales were 2.8%, but the government started to show some drag on the economy in the quarter. Overall, the biggest contributions to growth came from personal consumption, exports and private investment while the government took nearly a full point off. Inflation remained weak. The big takeaway was that the private sector still looks pretty healthy and if the government weren’t dragging down growth we’d be that much stronger.

- Jobless claims came in at 348K vs the prior weekly reading of 326K. The labor market is sort of stalling here so this doesn’t bode too negatively or positively for the jobs outlook.

- Pending home sales index came in at 92.4 vs the prior reading of 101.7. Housing data continues to hit the skids.

1 Pretty Picture:

Real GDP expanded by 3.2% in the fourth quarter of 2013. It was another quarter of solid growth that confirmed 2013 was a modestly good year overall. Overall, annual growth for 2013 came in at 2.7% which was higher than the average rate of 2.4% and 1.9% that we’ve seen since 2010 and 2009.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.