The US stock market has hardly budged this year. And given some of the turmoil in Europe and China some might be inclined to wonder why we haven’t started to see a big decline in US stocks. The answer lies in the fact that we’re not seeing a big pass through effect from China and Europe into the broader economy and corporate earnings.

According to FactSet the Q2 earnings so far look surprisingly okay. Earnings are growing 5.4% ex-energy and -1.3% with energy. Revenues are weaker at 1.3% ex-energy and -3.3% with energy. Of course, we can talk about record buybacks and the corporate engineering of higher earnings, but the fact is that the market doesn’t care about our opinion of this “manipulation”. It cares about what the actual bottom line says.

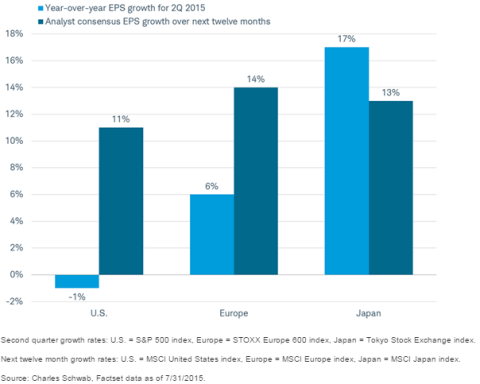

The story looks a lot better in some foreign markets. Jeff Kleintop at Schwab notes that growth abroad is far better:

Four times a year we get to take a look at the real impact developments around the world are having on an important driver of stock prices over the long-term: earnings. At about the halfway point in the second quarter earnings reporting season, compared to a year ago earnings are expected to have:

• declined slightly (-1%) for companies in the U.S. S&P 500 index,

• accelerated (+6%) for companies in the Europe STOXX 600 index, and

• rebounded sharply (+17%) for companies in Japan’s TOPIX index,

So, the long story short is that the decline in energy is having a substantial impact on earnings as a whole, but the ex-energy economy is not as weak as this story says. And the reason the US stock market probably hasn’t declined substantially is due to the fact that there is now some pent up upside risk if energy prices rebound and lead to better than expected growth in the energy sector. After all, if energy starts to positively contribute to growth in the coming year then those earnings expectations are going to rebound as well. So, in a strange way the US stock market might be telling us that it thinks we’re closer to the bottom in oil prices than the top. In other words, all this global turmoil isn’t going to sink corporate America and that means the stock market is beginning to discount the economy being closer to an energy trough than some might think.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.