Here are some things I think I am thinking about over the weekend – negative rates, lost manufacturing jobs and debt fallacies of composition. Where did my life go so wrong that I spend my weekends thinking about these things? Perhaps a post for another day….

1 – Shorter Ben Bernanke on Negative Rates – this isn’t a big deal….Ben Bernanke had a wonderful blog post late last week on the remaining tools left for the Fed and the impact of negative rates. The whole post is a nice read as he covers a good deal of ground and provides a nice explanation for many of the recent worries regarding Fed policy. The most interesting point to me revolved around negative interest rates. In short, he had a nice way of saying “this won’t really do much so let’s not get too worked up over it”. I agree 100%.

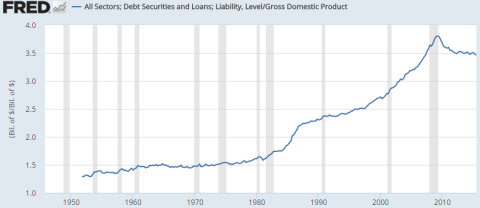

2 – Fallacies of Composition, US Debt Edition. You know what really bothers a nerd like me? When someone talks about one side of a balance sheet without acknowledging the other side. For instance, how many times do we hear about debt dynamics in solitude? The most common one involves charts of either US aggregate debt or US government debt as a percentage of GDP. Something like this comes to mind:

(Total Credit Market Debt to GDP)

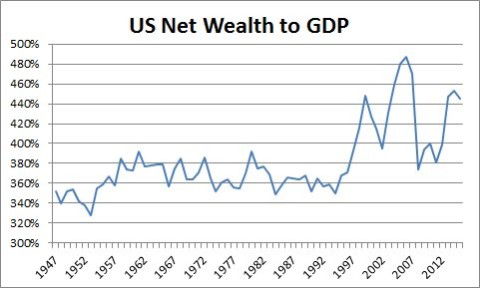

That sure looks scary. But what if I actually calculated the asset side of the balance sheet and then subtracted the liabilities? What would the picture look like then? You’d get something that looks like this:

(US Net Wealth to GDP)

Wait, it’s even higher! That doesn’t fit my scary narrative. Precisely. By looking at the balance sheet comprehensively you realize that scary charts aren’t always that scary. They just don’t tell the whole story and in the case of this story, it’s obvious that net wealth is actually higher which means the value of our assets vastly outstrip the value of our liabilities. Of course, this isn’t all good news. I’m just eye balling this chart, but it sure looks like it correlates pretty closely with assets bubbles in the Nasdaq, housing market and whatever this environment is….That might be a post for another day.

3 – Those Manufacturing Jobs are Never Coming Back. Ben Casselman had the post of the week on manufacturing. The short story – all those manufacturing jobs we’ve lost overseas? Yeah, they’re never coming back. Ben does a really nice job putting the reality of manufacturing jobs in perspective. The short story is that we’ve already seen some reshoring of these jobs and they’re not all that substantive. The main reason – the US economy is becoming increasingly less manufacturing based and the remaining manufacturing that’s being reshored is being automated. So, don’t expect some big renaissance in the manufacturing space no matter how many empty promises Bernie Sanders and Donald Trump make on foreign trade.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.