If I’ve seemed unusually busy in the last 6 weeks there’s a good excuse for that – we bought a new house. Our first house, actually. As a Southern Californian I’ve never been convinced by the financial benefits of owning a house. After all, buy/rent comps in this area tend to be similar to those of New York and many other big metropolitan areas where it has been a smart financial move to rent because buying is relatively expensive. But my view has changed a bit in the last few years and I wanted to detail why that is:

1 – Relative Asset Comparisons Don’t Look that Attractive. A key driver behind my decision was relative asset comps. After having been a long-time bear on housing my view changed in 2012 when I said housing looked relatively attractive for the first time in a long time. I didn’t buy a house then in large part because I thought I’d do better with excess cash in other financial assets. While house prices have increased by 37% since then a simple 60/40 stock/bond portfolio is up 55%. I don’t think this is likely to persist, especially on a risk adjusted basis.

The thinking here is relatively simple. We know that the bond market won’t generate great returns going forward. At a yield of 1.75% ten year bonds aren’t making anyone rich in the next decade. And while I’d argue that stocks aren’t on the verge of a 2008 type of bubbly environment, I think it’s also safe to say that stocks aren’t going to generate high returns going forward due to current multiples, historical comparisons, etc. But stocks are notoriously difficult to predict in the near-term so let’s ignore that. What we do know is that most investors should be diversified. And we also know, for a fact, that a diversified portfolio of stocks and bonds is going to do one of two things:

- It will generate lower returns on average because of the low yield environment and the drag from the bond component.

- OR, stocks will make up for the drag from bonds, but will NECESSARILY expose the investor to more volatility and permanent loss risk as stocks are an inherently riskier financial asset. This will make the aggregate portfolio riskier on average.

From the perspective of risk management it’s prudent to assume that, on a risk adjusted basis, future returns in a diversified portfolio will not be as good as we’ve become accustomed to in the past when a portfolio like the 60/40 benefited tremendously from high risk adjusted returns from the bond piece. And while a portfolio of bonds still yielded almost 3% five years ago we’re now down to 1.7% in a bond aggregate. In other words, a diversified portfolio of stocks and bonds looks increasingly risky due to the fact that the bond piece mathematically cannot pull its weight. And the lower yields go the more exaggerated this impact is.

While housing rarely looks like a highly attractive investment because of its high frictions (taxes, maintenance, fees, etc) it looks increasingly attractive compared to cash and bonds. And this is the kicker. Because the bond market’s future returns look so unattractive it’s prudent to consider other safe alternatives. In my case the choice was leaving a significant sum of money in a low yield bond portfolio or using the cash for a down payment that would provide me with the potential to match that return (historically, single family housing has generated a real, real return of about 0.8%) and many intangible benefits (like, the ability to run a chain saw on whatever part of my house I wanted to). So, when compared to a diversified bond portfolio the potential down payment on a house looks like an increasingly attractive option with the potential for similar upside AND many intangibles that renting doesn’t allow for.

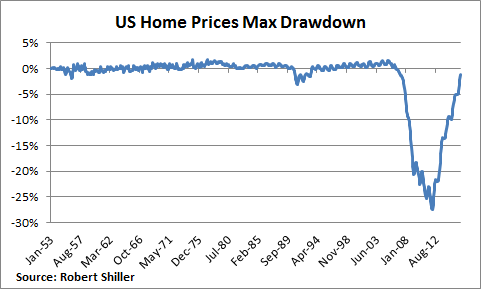

2 – Housing Does Not Resemble 2006. One of the main reasons this blog exists is because I was very bearish about the economy from about 2006-2010. The main driver of that was my view on housing and private debt. The main assumption in most risk assessment models that created the housing bubble was that housing was a historically stable asset that would not experience a lot of downside. So, you could package lower risk mortgages up into wrapper products and these higher risk assets would become lower risk assets because you’re diversifying across a historically safe asset. A lot of that was based on the following chart which, as you can see now, looks a little different to someone in 2016 than it might have in 2006:

(This is a pretty amazing chart, huh?)

But here’s the thing we need to ask ourselves – now that we know house prices can fall significantly we can’t necessarily think of them as the super safe assets that went into so many of those pre-crisis risk models. So, if you’re buying a house to live in it (thinking of it as a 10 year+ dwelling) then you have to ask yourself if you’re buying an asset that can expose you to such a significant decline that even a long time horizon can expose you to permanent loss risk? I would argue that today’s environment does not resemble 2006 in any way that makes housing as risky as it was back then. In essence, household debt trends are far improved, debt service ratios are far sustainable and most importantly, we haven’t had the housing boom that precedes a bust.

3 – My Life is Changing. When I was renting I enjoyed the freedom of knowing I could pick and go anywhere. This freedom allowed me to move across the country, live abroad and do many of the things that young people appreciate. But I am not the young buck I once was. I’ve found a community in San Diego that I love and I want to invest my time and effort in making that community a better place. In other words, I am putting down roots. Although a big part of this decision was financial I’d be lying if I said it wasn’t mostly personal. And that’s the thing about housing – as I argue in my book, a house should be a place you LIVE in. It’s not an investment or a mere financial decision. It’s an asset you live in mainly because of the intangibles, not because of the financials.

Of course, money should never be the overriding factor in our life decisions. If money rules your decision making process there’s a good chance that you’ve lost perspective on what are the ends and what are the means. After all, money is just a means to an end. It’s a tool we use to do the things that really matter in life. Reminding myself of this was important during this process because I don’t expect my house to be a great financial investment (though I hope it will be). But I KNOW it will be a great personal investment.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.