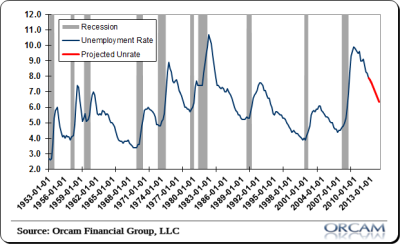

There was only one figure that mattered for the markets in today’s employment report and that was the unemployment rate. Yes, the actual headline figures matter and we all care about how many jobs are really being added, but the stock market isn’t concerned with whether we add 150K or 200K jobs so long as it’s decent growth in jobs. What the market is really concerned about at this juncture is the unemployment rate and when the Fed will begin to tighten policy. And as they’ve stated in the past, the number to look out for is 7%.*

Today’s report showed a rate of 7.6%. So, I still think we have a long way to go before any real tightening begins. As I said previously, that looks like 2014 at the earliest:

“So when will the unemployment rate hit 6.5%? As I mentioned earlier this year, we’re seeing clear signs of improvement in the labor markets. I predicted a 7% unemployment rate by the end of this year and so far that looks to be pretty much right on.

Looking ahead, we know a few things. The two big drivers of the unemployment rate have been the participation rate and the job gains. Recent trends have shown a modest decline in the participation rate as well as fairly healthy gains in jobs. Payrolls have averaged about 150K per month since 2010 and the participation rate has declined about 1/2 point per year.

If we just assume these trends continue and the participation rate declines by about 1/2 point per year and jobs continue to grow at the 150K pace they have since 2010 then we’ll see a 7% unemployment rate as soon as Q4 of this year and a 6.5% unemployment rate late summer of 2014. Of course, if the economy weakens then those are optimistic estimates. Either way, the Fed isn’t easing any time soon.”

* edit – the unrate target was recently changed from 6.5% to 7%.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.