* The following is a general overview of the purpose of modern banks and how they operate in a simplistic sense. This passage is an excerpt from Cullen Roche’s book “Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance”

The monetary system is designed to cater to the creation of the public’s money supply, primarily by private banks by establishing a money supply that is elastic. That is, it can expand and contract as the demand for money expands and contracts. Most modern money takes the form of bank deposits, and most market exchanges involving private agents are transacted in private bank money. As I have discussed, inside money governs the day-to-day functioning of modern fiat monetary systems. The role of outside money, which is created by the public sector, is comparatively minor and plays a mostly facilitating role (see here for a more thorough explanation on the difference between inside money and outside money).¹

Like the government, banks are also money issuers but not issuers of private sector net financial assets. That is, banking transactions always involve the creation of a private sector asset and a liability. Banks create loans independent of government constraint (aside from the regulatory framework). As I will explain, banks make loans independent of their reserve position with the government, rendering the traditional money multiplier flawed.

The monetary system in the developed world is designed specifically around a competitive private banking system. The banking system is not a public-private partnership serving public purpose, as the central bank essentially is. The banking system is a privately owned component of the system run for private profit. The thinking behind this design was to disperse the power of money creation away from a centralized government and put it into the hands of nongovernment entities. The government’s relationship with the private banking system is more a support mechanism than anything else. In this regard I like to think of the government as being a facilitator in helping to sustain a viable credit-based money system.

It’s important to understand that banks are not constrained by the government (outside the regulatory framework) in terms of how they create money. Business schools teach that banks obtain deposits and then leverage those deposits ten times or so. This is why we call the modern banking system a fractional reserve banking system. Banks supposedly lend a portion of their reserves. There’s just one problem here: banks are not reserve constrained. Banks are always capital constrained. This can best be seen in countries such as Canada, which has no reserve requirements. Reserves are used for two purposes—to settle payments in the interbank market and to meet the Fed’s reserve requirements. Aside from this, reserves have little impact on the day-to-day lending operations of banks in the United States. This was recently confirmed in a paper from the Federal Reserve:

Changes in reserves are unrelated to changes in lending, and open market operations do not have a direct impact on lending. We conclude that the textbook treatment of money in the transmission mechanism can be rejected.

This is an important point because many people have assumed that various Fed policies in recent years (such as quantitative easing) would be inflationary or even hyperinflationary based on the flawed concept that an expansion of the monetary base (reserves) would lead directly to bank lending and higher inflation. But well capitalized banks are not reserve constrained. Banks are always capital constrained (which can lead to being reserve constrained). But the order of operations is important here in that a well capitalized bank can always make loans and find reserves after the fact.

The concept of “reserves” sometimes confuses people, but reserves can be thought of as the bank deposits for banks. If we think of the banking system that we use then our deposits are primarily created by banks when they make new loans. But the banking system also has a banking system – the Federal Reserve system. And every bank must maintain an account with the Federal Reserve. This is the market where banks settle interbank payments (payments across different banks). You can think of the reserve system as a big clearinghouse for all the banks to settle payments with. This is always done in reserve deposits so banks are required to maintain a certain amount of reserves at all times. But we shouldn’t think of this clearinghouse as the center of the monetary system or even the point where loans are “multiplied”. That is, the fact that banks must maintain some level of reserves does not mean that they are constrained in their loan making by the quantity of reserves they hold.

That banks are not reserve constrained can mean only one thing—banks lend when credit-worthy customers have demand for loans (assuming the banking system is healthy and banks are engaging in the business they are designed to transact). Loans create deposits, not vice versa. In the loan creation process banks will make loans first (resulting in new deposits) and will find necessary reserves after the fact (either in the overnight market or through the Federal Reserve). If there is an insufficient quantity of reserves in the banking system to meet a reserve requirement the Central Bank will automatically supply them.

Understanding the business of banking is rather simple. It’s best to think of banks as running a payments system that helps us all transact within the economy. In addition to helping manage this payments system, banks issue money in the form of loans. Banks earn a profit from transacting business when their assets are less expensive than their liabilities. In other words banks need to run this payments system smoothly but will seek to do so in a manner that doesn’t reduce their profitability.

Banks don’t necessarily use their deposits or reserves to create loans in a dollar-for-dollar manner, however.² The traditional money multiplier depicts banking as a process in which the Central Bank supplies $1 of reserves and banks then multiply those reserves into $10 of new money or some other specific ration. But this fixed ratio concept is misleading at best. In reality, banks make loans and find reserves after the fact if they have to. In fact the whole process is the opposite of what textbooks depict. The reserve system is little more than a clearing system for existing or newly created deposits. So reserves, must, by definition, come into existence after deposits are created.

Banking is a spread business (having assets that are less expensive than liabilities) so banks will always seek the least expensive source of funds for managing their payment system. That just so happens to be bank deposits. This gives the appearance that banks only fund their loan book by obtaining deposits, but this is not necessarily the case. It is better to think of banking as a spread business in which the bank simply acquires the least expensive liabilities to sustain its payment system and maximize profits. Banks need funding sources to run their businesses, but they do not necessarily need reserves or deposits to make those loans.³

To illustrate this point I will briefly review the change in balance sheet composition between banks and households before and after a loan is made. Since banks are not constrained by their reserves, the banks do not need to have X amount of reserves on hand to create new loans. But banks must have ample capital to be able to operate and meet regulatory requirements.

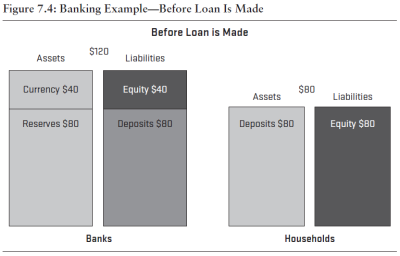

I’ll start with a simple money system shown in Figure 7.4. In this example banks begin with $120 in assets and liabilities comprised of currency, reserves, equity, and deposits. Of this, households hold $80 in deposits, which are assets for the households and liabilities for the banking system. That is, the bank owes you your deposit on demand.

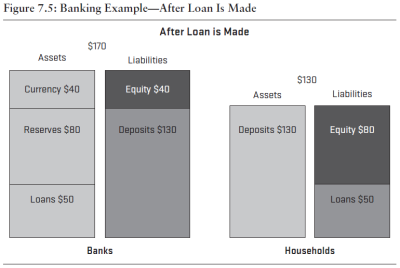

This banking system has reserves already, but this is not necessary for the bank to issue a loan. It must simply remain solvent within its regulatory requirements. But if the households want to take out a new loan to purchase a new home for $50, the bank simply credits the household’s account, as Figure 7.5 shows. When the new loan is made, household deposits increase to $130. Household loans increase by $50. Bank assets increase by $50 (the loan), and bank liabilities increase by $50 (the deposit).

If the bank needs reserves to help settle payments or meet reserve requirements, it can always borrow from another bank in the interbank market, or, if it must, it can borrow from the Federal Reserve Discount Window. The key lesson here is to understand that money in the modern monetary system is largely endogenous and exists through the creation of the loan process within the private sector.4 The central bank and reserves play a far smaller role in the broad money supply than is often perceived. Perhaps most important, this example shows that understanding endogenous money means we need to rethink how we teach banking and apply it to our understandings of the monetary machine. Banks and money are much more important than most modern economic models imply.

Sources:

1 – Inside Money and Outside Money, Lagos R. 2006.

2 – Repeat After Me: Banks Cannot And Do Not “Lend Out” Reserves, Standard and Poors, 2013

3- Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?, Federal Reserve, 2012

4 – Banks are not intermediaries of loanable funds — and why this matters, Bank of England, 2015

5 – Understanding the Modern Monetary System, Roche C. 2011.

NB – The idea that loans create deposits should not be misconstrued to mean that banks do not need deposits to manage their balance sheets. It is perhaps clearer to say that a bank manages its assets and liabilities in such a way that their assets contribute positively to their net asset/liability position. In doing so, deposits “fund” loans to the extent that they help the bank better leverage their operation into future loans and capital. As all entities need capital to sustainably fund balance sheet expansion it is better to say that all entities fund their balance sheets through sustainable capital positions. For more reading on this please see “Loans Create Deposits in Context“.