Mohamed El-Erian, the former PIMCO chief revealed an interesting personal asset allocation in a recent interview – he’s holding mostly cash. Here’s the specific excerpt:

Q. Where is your money? Stocks? Treasuries? Bonds?

A. It is mostly concentrated in cash. That’s not great, given that it gets eaten up by inflation. But I think most asset prices have been pushed by central banks to very elevated levels.

Q. So we’re nearing a bubble?

A. Go back to central banks. Central banks look at growth, at employment, at wages. They are too low. They don’t have the instruments they need, but they feel obliged to do something. So they artificially lift asset prices by maintaining zero interest rates and by using their balance sheet to buy assets.

Why? Because they hope that they will trigger what’s called the wealth effect. That you will open your 401k, see it has gone up in price, and you’ll spend. And that companies will see their shares are going up and they will be more willing to invest. But there is a massive gap right now between asset prices and fundamentals.

This is something I run into quite a bit these days. Investors are convinced that stocks are overvalued and excessively risky and they also believe that bond yields can only go up and will therefore result in principal loss. This leaves the investor paralyzed and unable to feel comfortable doing anything except sitting in cash. And the years go by and they find themselves simply losing out to purchasing power erosion.

The simple reality of the financial markets is that someone somewhere always ends up holding cash. Someone always feels like they’re falling behind. So don’t feel so bad about that part. But a 100% cash position is entirely irrational most of the time because it leaves you totally unprotected against inflation. For most investors, even the most conservative, we should be protecting against two risks:

- The risk of purchasing power loss.

- The risk of permanent loss.

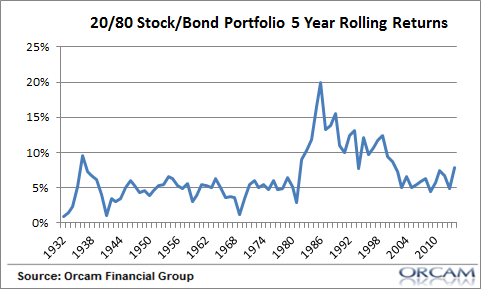

Let’s make an extreme point here for emphasis. Stocks might be risky, but that risk can be largely offset inside of a diversified portfolio. We all want the high return of stocks, but we don’t want the rollercoaster ride that comes with it. The reason we try to own uncorrelated asset classes is specifically so we can hedge the risk of high volatility assets like stocks. And if we look at the performance of an extremely bond heavy portfolio we can see just how much stocks help boost a portfolio. Historically, a 20/80 stock/bond portfolio (comprised of 20% US stocks and 80% 10 Year T-Notes) has never generated a negative return on a rolling 5 year basis (a reasonably long, but still fairly conservative holding period):

You’ll notice something glaring in that performance – the first 50 years look pretty different from the last 30 years. That’s because bonds have been in an unprecedented bull market over that period. And as I’ve stated before, this creates a very tricky environment for anyone who holds bonds – returns are going to be lower going forward than many people are comfortable with.

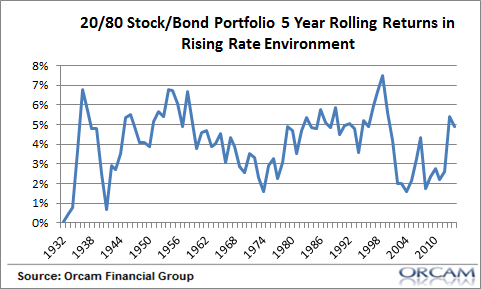

In addition, the 1970’s are a terribly proxy for a bond bear market despite the common comparison of the rising interest rate environment. The better comparison is the 1940’s when interest rates on the 10 year were quite comparable to today’s environment. And what we saw over the course of the 1940-1980 period was a persistent period of rising interest rates. But here’s the kicker – even during this period a 100% 10 year note portfolio generated a 2.17% average annual return. Adding even a small slice of stocks in a 20/80 portfolio lifted that return to 4.64% helping us beat the average rate of inflation of 4.51% over the same period. Not great, but not terrible. Better yet, not going backwards by 4.51% per year like you would if you were holding t-bills and cash equivalents.

Let’s stress test this even further though and assume that a 20/80 will generate the average return of the rising rate environment from 1940-1980 at 2.17%. And let’s take the 5 year rolling return of stocks and combine them across the entire history of stock market returns including the nightmarish 30’s. This portfolio generates very low historical returns, but again generates zero negative rolling 5 year periods. And every single period beats a 0% all cash return. Importantly, this includes the early 1930s when stock returns were -8.25% on a 5 year rolling basis. This shows that even in a rising rate environment with very volatile stock returns the rolling 5 year returns of a diversified portfolio can be better than cash.

Of course, history is not a perfect guide to the future. In fact, the future will look little like the past. We have to make some projections about the future. But the one thing we know for certain is that cash will lose purchasing power going forward. And while bonds might not generate good returns we can be somewhat creative about how we put together an asset allocation plan so that we create a high probability of earning a return that is better than a 100% cash portfolio earning 0% and helps us reduce the risk of purchasing power loss. Unfortunately, the periodic market crashes of the last 15 years combined with low interest rates continue to scare people out of the markets which leaves their savings excessively exposed to purchasing power loss. With a little bit of intelligent portfolio construction the future need not look like the scary environment that so many might think.

NB – This is not intended to imply that I endorse a 20/80 stock/bond portfolio (I would certainly prefer adding layers of diversification and uncorrelation in here), but rather is intended as a simple exercise in showing how our asset allocation plans can be implemented in such a manner that maintain fairly low risk portfolios while also beating a cash portfolio.

Related:

- The 1970’s Are Not a Good Proxy for a Bond Bear Market

- The Investor’s Conundrum

- The Most Important Question

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.