Michael Kitces has a very good post up discussing some of the big trends in the Robo Advisor space. Michael notes that the robo growth is falling off fast and that this could be a sign that the trend here is beginning to dry up. He ultimately concludes that the biggest winners here are the companies augmenting human advisory services with the benefits of the robo technology:

“advisor platforms are quickly seeking to build or acquire it to provide it to them, and the tech-augmented humans are increasingly pulling ahead of both their robo and human counterparts.”

I think this is pretty much dead on. When I wrote my original piece on the Robo Advisors I said that the endgame here was clearly some combination of human advisors and technology.¹ After all, a robo “advisor” isn’t really an advisor at all. It can’t risk profile you correctly, it can’t know your intricate financial details, it won’t help you stick with a plan when it looks like the world is falling apart, it can’t provide the appropriate financial planning needs, etc. As I’ve stated before, these services are just Robo Allocators. And if you ask me, they aren’t doing anything all that sophisticated so the value proposition is limited from the start. Let me explain why I believe this realization is driving the slowdown in growth we’ve seen.

1 – Robos Build Fancy Looking and Expensive Versions of the Vanguard Three Fund Portfolio.

One of the points I highlighted last year was the fact that the Robo portfolios all mimic some version of the Vanguard Three Fund Portfolio. That is, they take 6-20 positions and build something that almost perfectly resembles the specific allocation of the much cheaper Vanguard portfolio. The result is that you’re adding the management fees of the Robo on top of the expense ratios of the underlying funds resulting in a high fee version of something very simple:

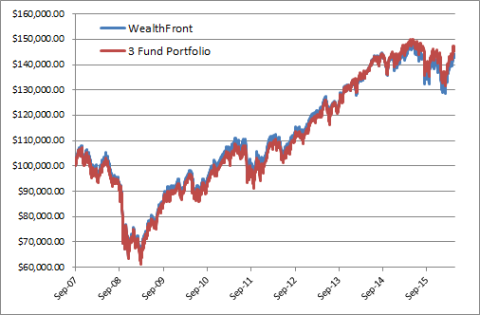

(WealthFront Moderate Profile vs Vanguard 3 Fund Portfolio)

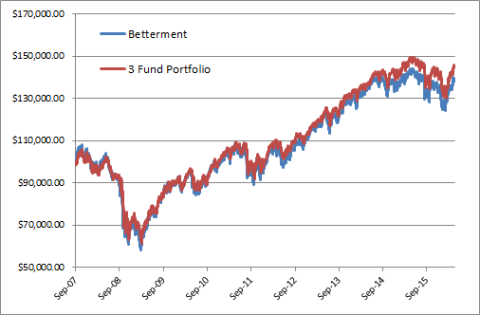

(Betterment Moderate Profile vs Vanguard 3 Fund Portfolio)¹

As you can see, the performance is nearly identical. And if you can rebalance once a year and harvest some losses on your own it becomes difficult justifying a management fee for this. This is ultimately the biggest impediment to Robo Advisor growth. As more people use these services they’re realizing that what they’re getting is little more than a really simple passive portfolio that they can easily build on their own without the Robo middleman. There are some side benefits like tax loss harvesting and the automation of the rebalancing/reinvestment, but it’s not going to be worth it for anyone who has the time to look at their portfolio a few times a year (which is everyone).

2 – The Stock Market Scare Exposed the Same Old Flaws in Traditional Portfolio Theory.

The Robo advisors all pride themselves on using “Nobel Prize winning” approaches to investing. But this approach has also exposed the same old flaws we saw during the financial crisis – most portfolios constructed using Modern Portfolio Theory will have highly correlated equity heavy allocations. Even more “balanced portfolios” constructed using Modern Portfolio Theory are not really very “Balanced” at all from the perspective of drawdown risk.

One of the key points I highlight in my new paper on portfolio construction is the need for balanced risk in a portfolio. And when you measure risk by the academic notion of volatility you tend to arrive at portfolios that are always equity heavy which is the case with the Robos. This creates a temporal conundrum and behavioral problem for most asset allocators – are you willing to go through potential periods of substantial unrealized losses in exchange for the potential that you will make it all back “in the long-run”? The cause of this is the fact that stock heavy portfolios are always overweight purchasing power protection (reaching for gains) at the expense of permanent loss protection (protecting against downside exposure). This is because bear markets will expose a traditionally “balanced” portfolio like a 50/50 stock/bond portfolio to excessive permanent loss risk since 85%+ of the downside comes from the stock component. That is, even a 50/50 stock/bond portfolio is not balanced at all as the majority of the negative volatility comes from the 50% stock piece.

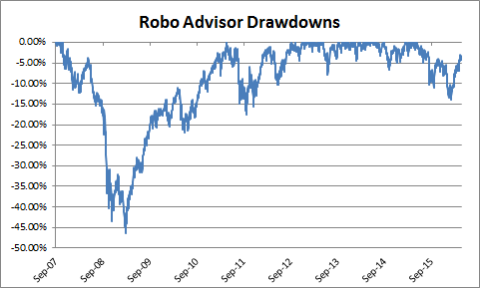

The two portfolios mentioned above are the moderate profile portfolios for two of the dominant Robo firms and these portfolios will undergo 40%+ declines in a bear market like the 2008 crisis.

(Betterment Moderate Portfolio Drawdowns)

These are extraordinary drawdowns for a moderate risk profile. To put this in context, a moderate Robo portfolio is designed in such a way that it will take on almost 85% of the downside risk of the S&P 500 during bear markets. That’s quite the rollercoaster ride for most people and not the level of certainty they want from their savings. I’ve referred to this as a major flaw in Modern Portfolio Theory, but I suspect that the deficient risk profiling process in the Robos is compounding the problem by placing the vast majority of their clients in portfolios that are exposed to substantial negative volatility. The cause of this is simple – they’re trying to be fiduciaries who serve the best interests of their clients when the reality is that they are asking 4-5 insufficient questions in the process of risk profiling and then placing you in a very general allocation that could be wildly incorrect because they don’t actually know their clients. The result in many cases is an overly aggressive and insufficiently customized portfolio.

I suspect that these are the two primary drivers of the slowdown in Robo growth. But despite the flaws in these approaches I have to disagree with Michael to some degree. I don’t think the recent weakness in asset flows are the death of the Robos. I suspect something bigger is happening and these firms are merely pushing the human advisory space in its logical direction – towards a much lower fee platform. After all, while I am here criticizing a portfolio that costs 0.28%-0.38% (Betterment and Wealthfront’s all-in costs on portfolios over $100K) I would be remiss if I didn’t also clarify that I think it’s absurd that most advisors still charge 1% for constructing something that is usually the same. So no, this isn’t the end of the line for the Robos. In fact, it’s all just the beginning of a long-term decline in human advisory fees. And the combination of these new technologies with lower human advisory fees will create a nice blend of real advisory services with low cost investing. But we’re not there yet. Human advisory fees have a long way to fall and I suspect that the human advisory space will contract substantially more (in relative size to the Robo space) before all is said and done.

¹ – See, Should You Use an Automated Investment Service?

² – In order to perform these longer backtests I used the JPM GBI for the global bond piece that Betterment uses.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.