Recency bias is a real sonofabitch. After someone goes through a traumatic experience they tend to be shocked into believing that the next big traumatic experience is right around the corner. But the reality is that outlier events are outlier events for a reason – they don’t happen nearly as often as we expect. For instance, I was in a car accident this past weekend. I was driving in one of these wonderful ride sharing programs when a car sideswiped us blowing through a stop sign. I was fine (everyone else was not), but as I drove around the rest of the weekend I stopped at every intersection even though there weren’t stop signs at them. Then, three days later I found myself barreling down the I-5 like normal after the trauma and recency bias had passed. ¹

There’s been an incredible amount of recency bias following the trauma of 2008. The next big crisis has been around the corner ever since. And this brings me to the junk bond market. In his recent video Carl Icahn compares today’s environment to 2007 saying that the crisis wouldn’t have been as bad if more people like him had spoken out. I don’t think that’s actually true at all since the mortgage crisis was in motion long before anyone with substantial influence could stop that. But he specifically notes that the junk bond market is going to become a “bloodbath” at some point in the coming years. Let’s look at some data for a better perspective.

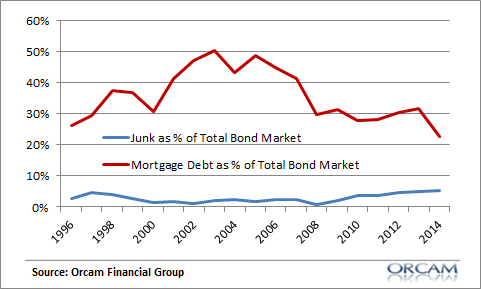

Here’s a chart showing the size of the mortgage market and the junk bond markets in the USA. The red line is the quantity of mortgage debt issuance as a percentage of the total bond issuance and the blue line is junk debt issuance as a percentage of the total. While junk has risen substantially in recent years you can see a pretty stark difference here. Junk bonds are a relatively small slice of the overall pie whereas mortgage debt is massive.

In the years between 2000 and 2007 the US economy issued $18 TRILLION in new mortgage debt. In the years between 2008 and 2014 the US economy issued $1.6 trillion in new junk bonds. So, this debt bubble in junk bonds is substantially smaller than the mortgage debt crisis which led up to the Great Financial Crisis. The shorter version is that junk bonds finance a relatively small slice of the US economy while mortgages finance the most important asset in the economy. So, in my view, comparing the junk bond bubble to the housing bubble is highly misleading.

Does this mean junk bonds are a great value? Not at all. I’m on the record going years back (see here and here) citing worrisome trends in junk bonds. There are going to be lots of defaults the next time the cycle cracks. And we’re probably already seeing that in the energy space where many junk bonds were financing what is now unprofitable shale businesses. But that doesn’t mean we’re staring at a 2007 type debt crisis in the USA.

¹ – I probably don’t have to tell you this, but driving is statistically the most dangerous thing we do every day (aside from watching the news, eating most of the foods we produce and waking up). If you don’t wear your seat belt and drive like a total wuss then you’re doing it all wrong. I personally am a strict disciple of the wear-your-seat-belt-and-drive-like-death-is-around-the-corner approach.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.