It’s the Monday following the second leg of the Triple Crown and a whole bunch of people lost money betting on the Preakness. Like the stock market, the allure of gambling is strong because many people think that having more money will solve most of their problems. And while there are some similarities between investing and gambling we should be clear that they are not nearly as similar as some people might believe.

First, some definitions:

Gambling is placing capital at risk in a zero sum game with an uncertain outcome in a system in which the odds are generally unfavorable over long periods of time.

Investing, on the other hand, is placing capital at risk in a positive sum game with an uncertain outcome in a system in which the odds are generally favorable over long periods of time.

One way to think of this is that the pool in a gambling game grows only because more people join the pool. The pool of money in a lottery drawing grows because the number of participants increases and the relative value changes hands. On the other hand, the investing pool (like a stock market) grows not only because of new participants but also because the absolute value of the pool changes. The stock market does not increase in value because cash “flows” into the market or because new investors join the old. It changes in value because the actual assets get repriced to reflect changing expectations of future cash flows.¹

Now, technically, investing is spending for future production. Building companies, widgets, creating real value, etc. Investment is funded by issuing shares of stock or bonds. Once those shares trade on the secondary market they are continually repriced by current participants based on whatever new buyers/sellers believe those shares are worth. The big difference between owning stocks and owning a horse betting ticket is that the stock is attached to something that has a high probability of being more valuable in the future – human output. The horse ticket, on the other hand, has a very high probability of being worthless in the future. Of course, human output doesn’t grow overnight so the shareholder who day trades or is excessively focused on the short-term, is doing something very similar to what the gambler is doing – they are gambling on the hope that someone will buy their shares at a higher price than what they paid.²

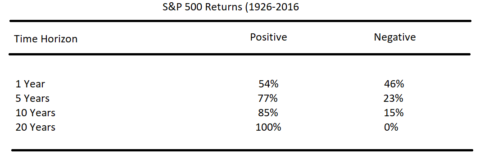

The kicker here is the zero sum vs positive sum nature of the temporal events. That is, the longer you invest the more likely you are to earn a positive return because you’re simply allocating your savings to the productive output of the economy, which typically grows over time. This is especially true when you diversify your assets in something like a low cost ETF which reduces the probability of single entity risk. Gambling, on the other hand, is specifically designed so that the longer you play the more likely you are to lose. Casinos don’t give you free drinks because they love you. They give you free drinks because they know that the longer you sit at their tables the more likely they are to take your money. Investing is the exact opposite. It’s not so much about timing the market as it is time IN the market.

Unfortunately, too many people fall victim to the idea of getting rich quick in the stock market or confuse gambling with investing. And unfortunately, I suspect all of this is a drag on society since, if we understood investing for what it really is, there would be a lot less people gambling in the stock market and instead doing things that would add to aggregate output thereby making us that much wealthier in the long-run.

Related – The Stock Market Isn’t Where You Get Rich.

¹ – This is the old “cash on the sidelines” myth.

² – Contrary to popular opinion, the stock market is not a zero sum game. It is a zero sum game in the short-term, however, in the long-term the stock market is a positive sum game (assuming higher productive output in the future and higher asset prices).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.