Jake at Econompic has a nice post up on Margin Debt showing that it is, at best, an unreliable metric. This is generally true with debt based indicators. How many times have we seen charts of debt to GDP or high personal debt levels or high corporate debt levels over the last 10 years? These data points are constantly bandied about as harbingers of doom. Of course, looking only at the liability side of a balance sheet is silly. It tells you nothing if you don’t put it in some context and understand how it relates to other parts of the economy and the other side of the balance sheet.

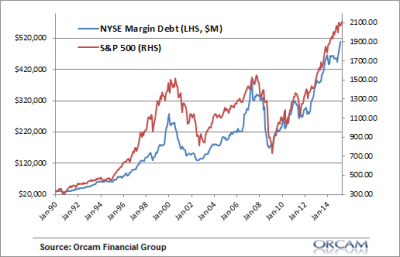

It’s alluring to look at a chart like the one below and conclude: “well, high debt levels are scary, record high stock prices are scary so that means that the stock market is at an unusual risk of collapse”. This may or may not be true, but again, we have to keep things in some context because debt levels should be expected to grow across the entire economy as things improve. What could make this debt growth worrisome is when it grows disproportionately in what is known as a disaggregation of credit. That is, when debt grows disproportionately in the use of unproductive or unsustainable endeavors then it fuels an inherently fragile boom that creates higher than normal risk. The housing crisis is a perfect example. When low credit borrowers started borrowing to speculate on houses they couldn’t afford this created fragility in future housing prices. Add on Wall Street’s leverage and you had a recipe for disaster.

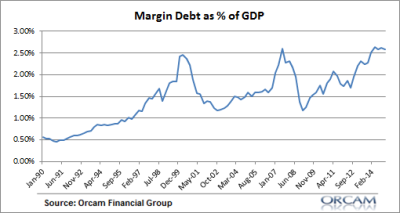

When taken in a broader context the margin debt situation is inconclusive at best. As a % of GDP margin debt is at an all-time high. This would appear worrisome were it not for the next chart.

Margin debt as a % of total market cap has basically been flat ever since the financial crisis. So, despite all time highs in the S&P 500 margin debt as a % of total market cap hasn’t really expanded at a rate that is all that alarming.

This highlights the most important part about the growth in margin debt. It isn’t the growth in debt that is worrisome. It is the growth in the asset that this debt might be fueling that could be worrisome. So, during the housing crisis it was not the debt that was actually so worrisome. It was the instability in housing prices that was worrisome. All the debt did was fuel the boom and exacerbate the bust. But the real cause of the instability was the price of housing. The same is true for the stock market and margin debt.The debt will only be worrisome if we assume that the stock market is at an unsustainable level and that margin calls and debt repayment could fuel the downside.

I’ve repeatedly stated over the years that the stock market does not appear to be in a bubble. And although I am hardly excited about future growth prospects I still think we have to be very careful about applying the term “bubble” to current stock market prices. And that means margin debt at record high levels probably isn’t as large a concern as some might have you believe.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.