Brad Delong is right to reject the idea that there is a bubble in bonds. I’ve stated this position on several occasions over the last 5 years. And I think it’s worth going into in more detail because there is a dangerous connotation that goes along with the idea of a “bubble” in any asset class.

I like the point that Brad makes pertaining to tail risk. He says:

“Owning bubbly assets entails large long- and fat-tailed risks.”

The term “bubble” is scary because bubbles pop and when bubbles pop they disappear. In the investment world this implies a substantial risk of permanent loss. But let’s put this in some historical and operational perspective.

It’s important to note that a bear market in bonds is nothing like a bear market in stocks because bonds are a very different type of security than stocks. A fixed income instrument has several embedded safety components that make it entirely different from stocks:

- It’s higher in the liquidation chain.

- It pays a “fixed income” over the course of its life.

- If held to maturity fixed income pays you back at par.

- The duration on a fixed income instrument is generally shorter than that of common stock.

This is why I’m such a stickler for understanding the monetary world at an operational level. If you don’t understand the operational dynamics behind certain entities, institutions and instruments then you’re much more likely to make big investing mistakes. And this operational perspective explains why fixed income is inherently safer than common stock.

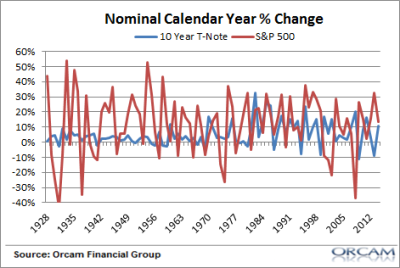

We can also see this in the performance data. Since 1928 the 10 year US Treasury note has been negative in just 14 calendar years. Those negative years averaged a -4.2% return. Stocks, on the other hand, have been negative in 24 of those calendar years and with an average decline of -13.6%. The worst calendar year decline in stocks was -43% while the worst calendar year decline in bonds was -11%. So it should be clear that a bear market in bonds is very different from a bear market in stocks.

I don’t know if bonds are currently in a bubble. I’ve stated my opinion that they currently look a little frothy, but I would not classify them as bubbly. They certainly look a lot less attractive to me right now than they have at times over the last 5 years. Either way, I think it’s important to remember that a big bear market in bonds will not resemble the types of big bear markets in stocks that are often referred to as “bubbles”.

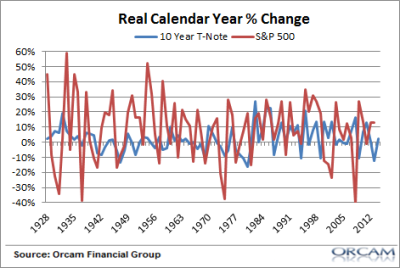

Update: For added perspective here is the real return in stocks and bonds as well. As you can see the calendar year figures don’t change much even when we adjust for inflation.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.