Do you remember the movie Tremors with Kevin Bacon about underground monsters? It was terrible. But they ended making like 5 or 6 of them. It was like a bad nightmare that wouldn’t end. Which is similar in many ways to a recurring theme on this website where I explain how the USA isn’t bankrupt.

I was reminded of this while reading this post titled “Tremors” by Stanford economist John Cochrane in which he explains how rising interest rates pose a threat to the US government’s ability to finance its debt.

Now, I think Cochrane is overlooking some important macro factors here and I’ll just briefly cover them as a refresher before jumping into the more specific details:

- The US government sits in a uniquely special position in the global monetary system since it’s the entity that can tax the most productive private sector in the world. Its credibility as a safehaven financial asset issuer is unmatched because its private sector output is unmatched. Many people get this precisely backwards and think that the US Dollar is a strong reserve currency because of some global currency arrangement or government conspiracy when the reality is that the US government is the dominant reserve currency issuer because its private sector produces huge quantities of high quality goods and services denominated in USD.

- Part of Cochrane’s post talks about the risk of the USA experiencing a European style financing problem. This is a false comparison since the European Central Bank is essentially a foreign Central Bank. The Federal Reserve will always standby to “finance” the debt issuance of the US government so we need not worry about being able to sell government debt. In other words, the USA cannot run out of money since it can print debt.

- Of course, the US government could encounter high inflation. In this case bond markets would reprice debt regardless of what the Fed was doing and it would have catastrophic effects on the well-being of the private sector. As of now, high inflation is hardly a concern. This is not to say that inflation couldn’t become a problem, but we shouldn’t confuse a high inflation or a hyperinflation with having the same causes as a nominal insolvency (see here for a more thorough explanation).

That said, let’s explore this idea that yields will rise much more as inflation rises and the government has to finance its debt.

Let’s start with an important oversimplification in Cochrane’s analysis:

“At $20 trillion of debt, when interest rates rise to 5%, interest costs rise to $1,000 dollars, essentially doubling the deficit. “

$20 trillion is the figure you hear in the news when people decide to talk about the liability side of the US government’s balance sheet without also mentioning the massive asset side of that balance sheet. When we properly account for the entire balance sheet the US government is probably the wealthiest entity in the world and focusing solely on the liability side is an abuse of proper accounting.

But there’s more. $20 trillion includes roughly $7.8 trillion that the US government owes to itself. This includes Public Pensions, Social Security and debt held by Federal Reserve banks. So the debt held by the public is closer to $12.2T. Now, the Office of Management and Budget includes the debt held by the Fed Banks as part of their public debt figure so they list this figure at $14.6T. But that figure is a bit misleading since The Fed could easily roll $2.4T over into overnight debt yielding whatever it wanted since it holds it itself and pays current interest back to Treasury.¹

Still, working with that $14.6T figure you don’t get anywhere near Cochrane’s $1T in annual interest. The reason for this is because the average weighted maturity of the national debt is way below what a 5% Bond would be the equivalent of. As of the end of last year the average weighted maturity of the public debt was about 5.8 years. That was about 1.2% last year or about $265B. With rates having jumped this figure is closer to about a 2.8% interest rate or about $410B per year.

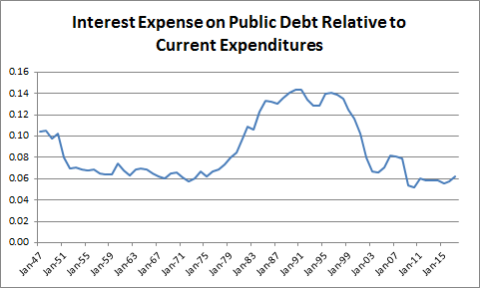

So let’s assume rates jump to an average that would result in the equivalent of a 5% rate on the public debt. In that case we’d end up paying about $733B in annual interest. To put this in perspective, that would be about 17% of current federal expenditures. That would be a big jump from where we are, but not much higher than where this level was for most of the 1980s and 1990s.

Would that “make markets nervous” as Cochrane says? I don’t know. Did it make markets nervous in the 80s and 90s? Did it bankrupt the USA? Or is this a concern that we keep rehashing every few months without properly understanding the scope of the issue and the underlying monetary operations? Worse, is it just some silly trope that keeps being repeated because some people have a political motive to always argue that the national debt is bankrupting America? I don’t know the right answer, but like the movie Tremors, this looks like a boogeyman that is scary in theory and not so scary in reality.³

Sources:

¹ – An American Budget, OMB, February 2018

² – Treasury Presentation to TBAC, US Treasury, December 2017.

³- To understand more about this recurring nightmare and why it’s not so scary please read “The Biggest Myths in Economics”.

NB – This whole post assumes that more interest payments would be a bad thing. As if the private sector doesn’t want to earn higher safe income from the government. As I’ve long argued, I believe a larger deficit in this environment would be stimulative because there’s a lack of safe interest earning assets in a world where the private sector remains excessively burdened by debt.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.