As an independent financial consultant I do a lot of investment advisory audits. That is, I spend a substantial amount of time reviewing portfolio managers, financial advisors and trying to help people steer clear of industry myths and value drags. Helping investors understand what their advisor/manager does (or doesn’t do) is crucial to being able to help my clients.

In the last few years a new “advisor” has entered the fray – the robo advisor, now being called “automated investment services”. Automated investment services are platforms that automate your investment portfolio and try to help you reduce fees, increase efficiencies and streamline your process through a simple computerized interface. With increasing frequency I am encountering the same question from my clients – “should I consider using an automated advisor?” You have probably started to hear about some of these firms like WealthFront or Betterment so let’s explore this further.

First, let’s look at the positives here because there are many benefits that are going to come from an increasingly automated investment advisory landscape.

The four primary benefits are:

1) More pressure to lower overall fees. Automated investment advisory firms will drive down broad fees as they undercut the traditional advisory business model through their low cost platform. This should substantially reduce the fees clients pay on average. This is fantastic news as I’ve long believed that investment advisory services are overpriced.

2) Automated advisory services will drive out many sub-par advisors. The ability to automate your advisory services means you don’t necessarily need a person to help you put together a financial plan. And this means that the rest of the advisory business will have increasing trouble proving their value. This means that sub-par advisors are likely to be driven out of the business over time as high fee structures and the lack of a value proposition renders them void.

3) Automation creates a systematic process. Portfolio construction and maintenance is all about having a plan and a process. These automated services are good ways to help you establish goals and maintain a strict adherence to a plan.

4) Some of the automated services are providing other valuable products that more closely resemble real financial planning and useful portfolio management. The recent news from Vanguard, for instance, that they’re combining these automated tools with real personal advisory services, is a sign that the robots can work with the machines. It actually discredits the pure Robo Advisory structure to a large degree, which I think is the right blend.

Another interesting example is WealthFront’s Single Stock Diversification Program which helps investors in public companies better diversify their portfolios. This can be a valuable service for someone who isn’t interested in paying high fees to have a major investment bank manage this service for you (although, this service doesn’t appear to be terribly sophisticated and if you talk to someone like, say, Mark Cuban, he’ll let you know that having a sophisticated banker like Goldman Sachs on your side here can be the difference between being a millionaire and a billionaire).

On the whole, these are incredibly positive developments for the advisory business and consumers. In short, automated advisory is changing the advisory landscape and forcing the entire industry to adapt and evolve with the times. But technology has always been problematic for financial advisory in several ways.

Let’s also look at some of the potential problems here:

1) These services are often referred to as “Robo Advisors”, however, these aren’t really “advisors” at all. Most of the Robo Services offer their free or low fee portfolio service as an automated investment service. They don’t have many of the benefits of a real advisor. For instance, Vanguard has shown that the added return from an advisor is as much as 3%. This is due primarily to behavioral coaching and the asset allocation that results from proper profiling. These automated services do not profile investors (because they can’t possibly know you at a personal level) and they do not stop you from changing your portfolio over time. In fact, because they don’t profile investors appropriately, they likely increase the odds that you will change your allocation as the markets change. A few of these services do offer a real advisor (such as Vanguards Robo), however, the larger well known services generally do not offer real financial advisory services or financial planning services.

2) Automated advisors reduce your fees by reducing your existence down to a number. You input your information, they output the data. It’s all automated. They often don’t know you, they don’t know your feelings, your family, your personal needs, goals, precise risk tolerance, etc. This is a big problem from a financial planning and portfolio construction perspective. It’s great to cut fees, but we shouldn’t be willing to reduce the quality of our financial plans just for a low fee advisory service. The pure robo advisor is a step backwards in this sense. It puts costs ahead of quality.

For instance, I ran through a “risk profile” on one of the major robo advisor sites using VERY conservative inputs (elderly, low income, no risk tolerance, etc) and the base output was a 42% risk asset allocation (stocks and commodities). That’s madness in my view. The most conservative portfolio ouput in this scenario would have lost 20-25% in a year like 2008. That’s terrible profiling of a client. But this is what happens when you take the human element completely out of the picture. You get reduced to a number in a computer algorithm and there’s no telling if that algorithm actually gets your profile right. In this case, it looks woefully lacking.

This is a tremendous problem. Getting your risk profile correct is, by far, the most important part of any portfolio plan. Unfortunately, because the Robo Advisors reduce you down to a simple set of questions and one number they don’t seem to profile their clients correctly. This appears to result in an asset allocation plan that is consistently more aggressive than it really should be. I have a feeling that the first time we go through a major bear market many clients will be shifting their asset allocations thereby resulting in taxable events that lead to the exact type of portfolio intervention that this type of service is designed to halt. In other words, by removing the human element of risk profiling upfront in an effort to save costs they are likely adding to back-end costs because many clients are likely to alter allocations later down the road.

I hope improved technology can be combined with the human quality of the necessities of a good financial plan. The best robo advisors won’t truly automate their services, but will utilize the strengths of technology WITH good advisors to enhance the quality of the output. As Erik Brynjolfsson says – we need to work WITH the machines. Not against them. The automated services, in an attempt to cut out the middleman entirely, have actually risked creating a model that is so simple that it actually misleads the client into designing a portfolio that may not be ideal for them.

3) Most of the portfolios I’ve seen coming out of these Automated Investment Services are constructed based on flawed foundations and actually increase portfolio degradation. This isn’t terribly shocking. Wall Street has been hiring mathematicians and building computer algorithms for decades. What these robo advisors are doing is just a dumbed down version of what many big investment banks are doing or what other investment managers have been doing for decades. Unfortunately, they’re advertising it as something totally unique, innovative and superior.

Most of the big Automated Advisory Services are using Modern Portfolio Theory and Efficient Market Hypothesis to construct portfolios. So they’re using flawed concepts like the Efficient Frontier and its nebulous concept of “risk” as standard deviation to construct portfolios. The results, as expected, are not promising when properly benchmarked.

To analyze this, I went into the two largest and most well known Automated Investment Services (Betterment and WealthFront) and ran through their basic risk profiles. When I say “basic” I mean a few questions, which, to be honest, is, deficient when assessing someone’s risk profile. Risk profiling is a process I generally spend DAYS assessing for clients since it’s one of the most important elements of portfolio construction. Not only do most clients have no idea what financial “risk” actually is, but they don’t understand how to properly connect the dots to an asset allocation plan because they’ve had the concepts of MPT and EMH jammed down their throats for the last 25 years.

Risk profile questionnaire’s are a fine starting point for building an understanding of risk tolerance, but they’re never enough because they’re necessarily incomplete and 95% of clients don’t understand what risk is and don’t understand how it relates to the portfolio (see here for a great discussion at Wealth Management on the inadequacy of risk profile questionnaires). A robot using standard deviation as “risk” and asking you 5 or 6 vague questions (assuming you even fully understand them) can’t break down these complexities on its own. But this is the problem with an atuomated service – you’re just a number in their algorithm and your output is likely to represent something that may or may not resemble who you actually are.

4) You shouldn’t pay a “management” fee for a buy and hold portfolio – especially one that picks funds inside of aggregates!

I went in and ran some quantitative analysis on some of these portfolio outputs. You can actually see what portfolios they’ll build for you so I was able to backtest the actual portfolios using a full market cycle and the actual funds they recommend. I ran the analysis using all the various risk profiles, but the outputs were all generally pretty close because the cookie cutter process they’re implementing is not very sophisticated and their reliance of MPT outputs something that pretty much always looks like a variation of the same buy and hold portfolio (ie, the actual weighting towards risk assets like stocks and commodities is usually in the 40%+ range and even higher when you consider how that variance contributes to what they’re defining as “risk” – in other words, because stocks and commodities are more volatile than bonds, generally by several magnitudes, the “risk asset” portion of the portfolio is actually much riskier than a 40% risk asset allocation would lead one to believe).

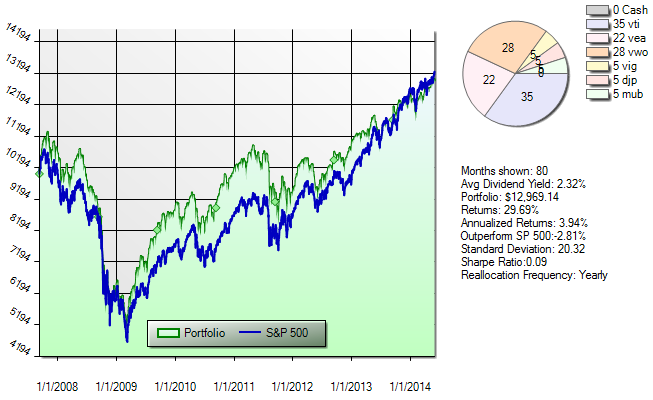

In WealthFront’s aggressive output, the high risk investor is invested in a portfolio that results in a 90/5/5 portfolio (stocks/bonds/commodities).If you run this portfolio against a simple 3 fund allocation using the Vanguard Total Stock Index, Vanguard Total Bond Index and the GSCI Commodity Index at a similar 90/5/5 weighting the numbers show that their “optimal” allocation is actually leading to portfolio degradation. The robo advisor output increases your risk and reduces your return by generating a 20.32 standard deviation, annualized returns of 3.94% and a zero Sharpe ratio. The simple 3 fund alternative, on the other hand, generates a 6.47% return, 18.15 standard deviation and 0.36 Sharpe ratio over the same period. In other words, this portfolio takes more risk, generates a lower return AND charges you a premium for it.

In the case of Betterment, they don’t use commodities (which I think is smart since commodities are nothing more than a hedging vehicle that comprise part of the costs of the capital structure and should never be an essential piece of a portfolio – ie, commodities generate flat real returns over long periods of time), but the results are essentially the same when properly benchmarked. When properly benchmarked and risk adjusted there’s no value add over a standard low fee aggregate index.

(Figure 1 – WealFront’s Aggressive portfolio vs the S&P 500)

The most conservative output generates the same results. On WealthFront, this “risk profile” outputs a 37/58/5 allocation (stocks/bonds/commodities). This portfolio generates a 4.98% return, 9.0 standard deviation and 0.38 Sharpe Ratio over the most recent market cycle. But again, if you compare this to a simple cookie cutter 3 fund index using the Vanguard Total Stock Index, Vanguard Total Bond and GSCI Commodity Index you again see portfolio degradation. In this case, the simple 3 fund portfolio generates a 5.77% return, 8.08 standard deviation and a 0.7 Sharpe Ratio. The robo advisor is trying to sell the concept of “diversification” by picking funds more specifically than a simple broad index. And in doing so they’re actually creating a portfolio that hurts your results.

What’s going on here is that the Automated Services are actually “picking” funds inside of aggregates. If they were true adherents to Burton Malkiel’s Random Walk theory they’d recommend the Vanguard Total Stock Index and the Vanguard Total Bond Aggregate, apply the proper risk tolerance and weightings and call it a day. Of course, if they did this most of their clients would turn around and ask why they need the robo advisor middleman when Vanguard can handle the two funds for them without the added fee. So what’s happening is they’re picking funds inside of an aggregate index (such as a municipal bond holding for the bond position, calling it “optimal allocation”) and then underperforming the aggregate – which is exactly what a pure indexer would expect. They basically sell a tactical asset allocation approach as being better than a true indexing approach and then call it a true indexing approach as part of their marketing plan. Then they benchmark it relative to a high fee active manager and call their portfolio “optimal” or claim it generates “additional returns”. I don’t like that one bit.

The portfolio construction is even more disconcerting than these points highlight, however. As I showed in my 2014 overview of these services, they are literally mimicking Vanguard funds, but layering on complexity and added funds to give the appearance of doing something better or different. For instance, both Betterment and WealthFront have aggressive portfolios that track the Vanguard Total World index with a 98% correlation. They are charging people an added fee for something that Vanguard already has in ONE fund. Why anyone would pay an extra fee for this is very confusing. This can easily be replicated on your own using a simple 3 or 4 fund approach or by purchasing a target date fund which is its own version of a Robo Advisor without the extra management fee.

5) Beware of the Robo Advisor “additional return” claims.

I found it quite alarming how some of the robo advisors calculated their “additional returns” they advertise. You can see these claims on the front of just about any of their websites. They generally claim anywhere from 4-5% in “additional” gains.

First of all, these firms are using index funds to construct portfolios. So the claim of 4-5% additional returns should be an instant red flag. The S&P 500 has averaged a real return of about 6% since 1925. No index fund implementation is coming close to DOUBLING that figure no matter how fancy their algorithms are. So some basic common sense tells us that these “additional return” claims look dubious.

In establishing the claim of “additional returns” the Robo Advisors misrepresent their benchmarks by comparing their allocations to active mutual funds or by citing studies using active management. THIS IS NOT PROPERLY BENCHMARKED. Of course, if you compare an index fund to an active mutual fund charging 1-2% per year then you can claim “additional” returns, but I have never seen anyone benchmark their portfolios relative to an active manager. The proper benchmark is a highly correlated passive index of equal weightings. But the Robo Advisors don’t do that comparison because then you’d see the results I posted above, which actually show that their results are worse than Vanguard’s most basic allocations.

Let’s look at this in more detail though. What you see on the Robo Advisor sites are claims that look something like the following:

Get Additional Returns with Robo Advisor XYZ:

Passive Investing +1.25%

Index Funds Over Mutual Funds +2.1%

Optimal/Better Diversification +0.5-1.4%

Automated Rebalancing +0.45%-

Tax Aware Allocation +0.6%

Tax Loss Harvesting +1%

Better Behavior +1.25%

Total Additional Returns: 4-5%

This is well constructed marketing and little more.

- First, it should be obvious that passive investing and avoiding high fee mutual funds will likely increase the return for the average investor. No one benchmarks portfolios relative to a high fee active manager so let’s just ignore claims about generating 1-2% increased returns from this.

- Second, the optimal allocation claims are dubious as I showed above and it’s probable that this figure is not just overstated, but potentially NEGATIVE.

- Third, any automated rebalancing is pretty standard and not necessarily a value add.

- Fourth, the “tax aware” allocation is something anyone can find on the internet via a simple Google search.

- Fifth, as Michael Kitces previously showed, the value of the tax loss harvesting is probably overstated. As I showed in my analysis on tax loss harvesting, there is no free lunch here. After all, we are talking about $3,000 in annual deferral which isn’t nothing, but for most investors will have a very minimal impact on future tax deferral and returns. Further, many of the large robos could be causing widespread wash sale violations in their customer accounts. And the claim about “better behavior” assumes an active portfolio management style.

- In other words, the 4-5% “additional return” claim is only true if you’re doing just about everything wrong with your portfolio, you don’t have an advisor of any type or you don’t have access to the vast online resources for do-it-yourselfers. In fact, as 2014 proved, the Robo Advisors didn’t add any return at all. They actually underperformed the S&P 500 across the board in their most aggressive portfolios. In the case of WealthFront they underperformed by over 8% and in the case of Betterment they underperformed by over 5%.

6) You Can Still be “Active” in your “Passive” Portfolio. Many of the robos advertise themselves as protecting you against yourself. In essence, they claim that the automation of their portfolios will result in less turnover and less portfolio intervention so you’ll avoid making big mistakes (like selling into a bear market). But this is totally untrue. You can actually alter your allocation in the Robo Advisor portfolios at any time you want. In essence, you can sell one allocation and buy another at any time. And the problem here, is that the robos don’t properly profile most of their clients so I think it’s inevitable that many of them will inevitably make allocation changes. In fact, because the robo portfolios are inherently aggressive I have a feeling that their will be widespread changes when the next inevitable bear market occurs.

The reality is that there are only a few ways to avoid the big behavioral biases. The primary one is to be ultra disciplined which is often easier said than done. The second is to work with an advisor who will act more or less as a personal trainer of sorts and keep you from doing silly things. The last way is to strap yourself to your bed after you construct your portfolio. Unfortunately, a pure robo portfolio doesn’t help you here at all.

Conclusion

There’s a lot of positives that are coming out of the Robo Advisor disruption. I hope that doesn’t get lost in this message. We’re likely to see increased automation, lower fees and fewer suboptimal advisors. That’s fantastic news. But I think you have to also approach their services with some skepticism. In general, a pure robo advisor will never replace a good financial planner because your financial plan can’t be whittled down to a set of numbers without some personal analysis. There’s simply no avoiding the human element there. It takes more than an algorithm to understand a human being’s mind and feelings. In addition, the investment management benefits are overstated in my opinion. I would not expect these services to generate “additional returns” relative to a well constructed passive index fund strategy. In fact, they’re very likely to underperform after their extra fees. And in the end they really amount to an automated rebalancing service. That is, you’re paying 0.25% or more per year just to have a computer automatically rebalance your portfolio. I don’t think anyone should pay a fee for automated rebalancing let alone 0.25%-0.85% per year.

I would follow a basic rule of thumb here. If you have a small portfolio or rather basic financial needs then the Robo Advisor can be a fine way to automate a process and better organize your finances. Smaller portfolios generally don’t pay any fees using these services so that’s a good fit. If, however, you’re a wealthy investor with sophisticated finances then I’d be hesitant to skimp on the quality of service in favor of what appears to be a low fee marketing pitch. And if you’re a sophisticated do-it-yourselfer then there’s probably not much a Robo Advisor can do that you can’t already do at Vanguard for a low fee on your own – paying a management fee for a suboptimal buy and hold portfolio just doesn’t make much sense.

Personally, I am always in favor of a DIY approach and or a more thoughtful low fee approach to asset management, but I understand that it’s not for everyone and depending on your personal needs a Robo Advisor could be appropriate for you.

And let’s keep things in perspective here – paying a Robo Advisor 15-25 bps for a simple, automated portfolio approach is 10X better than paying an actively managed closet index fund manager ON TOP of wirehouse style brokerage fees. So let’s all applaud the improvement in the industry. Unfortunately, I think there’s a lot of work to be done on improving the Robo Advisor model before it becomes useful to high net worth and more sophisticated clients. Vanguard seems to be on to something with their direction and I think the pure Robo Advisor firms are going to have to realize that people are more important than robots in financial management.

As of right now, there are simply too many problems in the underlying business model and portfolio construction process to be useful for anyone with a moderately high level of sophistication and planning needs so I am extremely hesitant to recommend these services over a reasonably priced alternative.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.