One of the consistent themes on this blog over the last few years has been a Trump stock bubble. It’s pure speculation, but it makes a lot of sense when you think about it – big talking business friendly capitalist wins Presidency, implements all sorts of business friendly policies and then talks about how great those policies all are. Stocks boom because, in part they should and also in part because this big talker keeps talking about them. Then stocks boom so much that they outpace the actual reality of the President’s policy impact and the air comes out eventually.

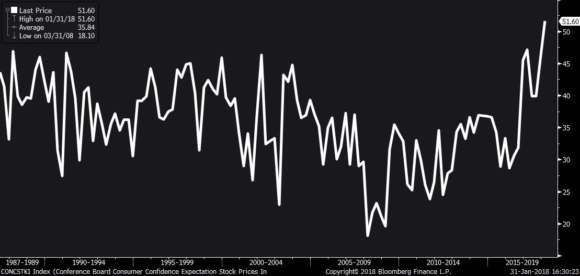

Anyhow, here’s a 40 year history of future stock market expectations. See if you can find the part where a President goes on Twitter almost every single day to talk about how great the stock market is doing:

(Chart via the fabulous Tracy Alloway at Bloomberg)

This is part of what makes me really uncomfortable with how Trump operates. Yes, he was always the stimulus candidate. I said that that was probably Clinton’s biggest policy weakness – she thinks budget surpluses are good and bad-mouthing corporate America is good for the economy. But the President’s “open mouth policy” is dangerous in my opinion because it creates the potential for financial instability.

Now, we’re in uncharted territory and I don’t love to go around talking about super short-term data that has zero empirical evidence supporting it, but from a logical perspective this all makes me really uncomfortable. The stock market is gonna do what the stock market is gonna do in the long-run. And that will very likely mean it goes up. But the process of getting there need not be distorted by a President who can’t control his Twitter handle. And focusing on the daily gyrations of the stock market is a pretty dangerous way to promote your policy agenda because it creates this risk that expectations get way out in front of reality. And that creates the risk that the financial markets (and people’s financial assets) become much more volatile than they should be….Here’s to hoping this data means nothing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.