I began my book with one of my favorite quotes of all time:

“The only wealth you’ll ever keep is the wealth you give away”

The quote, from Marcus Aurelius, is a perfect summation of how to think about work-life balance. One of the points I emphasized in the book is that you should think of your work as a function of investing in yourself in the pursuit of helping others. If you solve other people’s problems you’ll not only feel like you have a meaningful purpose, but if you do it especially well you’ll also get paid well. But the money isn’t the end. The money is just a means to other ends. The end is, of course, happiness and money is one tool that can buy happiness in certain ways, but will fail in many important other ways.

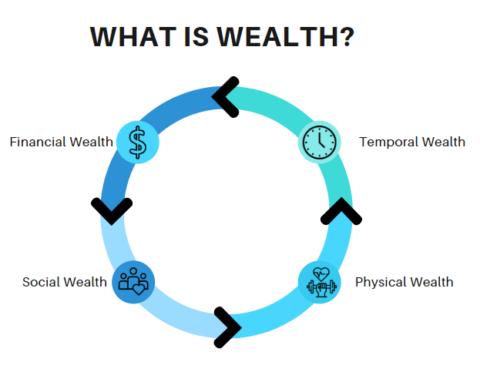

I view wealth across 4 quadrants including financial, social, temporal and physical. The four quadrants are interlinked and can amplify the other quadrants in important ways. For instance, if you have more financial wealth you probably have better access to the ability to maintain your physical wealth. At the same time, good social relationships will probably amplify your ability to earn an income. So on and so forth.

“Wealth” is a term we typically convey to describe financial wealth only. But true wealth is much broader than that and the pursuit of happiness cannot only focus on one or two quadrants. In order to find balance and happiness it’s important not to let the pursuit of money be confused with the pursuit of happiness.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.