If you’ve been reading my work for any of the last 10 years you know that I’ve sounded like a broken record for much of that time – the USA isn’t bankrupt, interest rates aren’t going to rise significantly and inflation is contained.

All of this was based on an operational understanding of the monetary system within the context of a reserve currency issuing economy that was recovering from an unprecedented debt crisis resulting from an asset bust. One of the big conclusions from this view was that the government could (and should) expand its balance sheet to offset some of the private sector’s weakness. I argued that the policy response from the crisis focused too much on Fed policy and not enough on fiscal policy. I think it’s fair to say that these views turned out to be fairly right.

Fast forward to today. The USA is still not bankrupt. In fact, we are wealthier, in aggregate, than we’ve ever been. Interest rates are moving higher. And inflation, while still contained, is moving a bit higher. I am not terribly concerned about surging interest rates and inflation. But there is still reason for caution regarding the deficit. Let me explain.

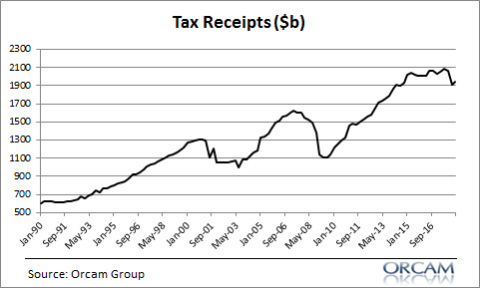

Typically, the deficit moves in a relatively countercyclical fashion. It is largely automatic as, during recessions, tax receipts decline and non-discretionary spending rises and, during booms, tax receipts jump and non-discretionary spending falls. The deficit ebbs and flows and as the private sector strengthens during a recovery the need for government assistance declines and so the deficit naturally recedes. This is a good thing as we get some extra support when we fall and the support gets reduced as we strengthen and rise.

What’s happening now is rather unusual though – the deficit is surging in a highly procyclical fashion due primarily to discretionary changes in the tax code. So tax receipts are declining during a boom.

The CBO estimates that all of this will result in a jump from a $665B deficit in 2017 to continual $1T deficits from 2019 until 2028. This trend in the deficit is potentially worrisome for two primary reasons:

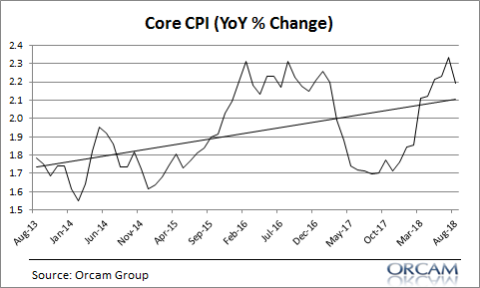

1. While inflation is currently subdued we should not be complacent about how quickly inflation can get out of control. I am inclined to argue that inflation will remain low, but the risk management part of my mind says there’s no reason to poke the inflation bear who is clearly waking up a bit.

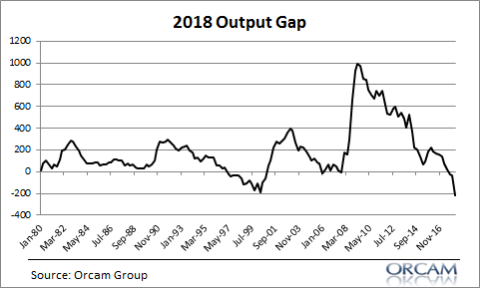

Further, parts of the economy are operating at or near full capacity so there is a much stronger argument for an uptick in inflation today than at any point in the last 10 years. For example, 2018 is the first year in which the output gap has shifted to a range consistent with an economy operating near full capacity.

2. Asset markets are booming and could pose risks to the economy. While financial stability is not an explicit policy target of the government perhaps it should be following the housing bust? The current environment can best be described as one where the stock market is booming and certain housing markets are frothy, if not bubbly. We know that the deficit adds to corporate profits and non-government savings. That could further exacerbate these booms thereby making the economy increasingly exposed to asset price busts.

I am an ardent supporter of countercyclical economic policies. When our economy is weak we can afford to support the fall. When the economy is strong we should not exacerbate potential booms and add to potential excesses. The private sector has arguably never been stronger than it is today. Why do we need government issued PEDs when we’re already running full speed on our own?¹

¹ – PEDS are Performance enhancing drugs such as steroids. Or Viagra.²

² – I have never tried Viagra, but gauging from the many commercials on TV it can result in up to 4 hours of performance enhancement which is about 4 hours more than I am used to.³

³ – Boy, these footnotes really got out of control fast. Like inflation can. Nevermind.

NB – I am not arguing for a budget surplus necessarily. I am simply pointing out that the deficit was moving in a natural countercyclical fashion prior to 2018 and using discretionary spending and tax cuts to move it in a more procyclical direction after a relatively long recovery carries risks that I believe are unnecessary.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.