It’s well known that the financial markets aren’t the economy. That is, the financial markets tend to anticipate and lead economic growth. But some people take this even further. For instance, this widely cited study by Credit Suisse showed that there was a negative correlation between economic growth and stock market growth. In fact, high growth economies often have the worst performing stock markets.

But there’s more to the story than this. As Ben Inker noted in the latest GMO quarterly letter (see here), there is often an underlying reason why economic growth doesn’t correlate with some stock markets:

“The biggest reason for this non-intuitive result is that the relationship between GDP growth and earnings per share (EPS) growth that most people assume must be there does not exist in the long run. The two developed countries with the strongest EPS growth between 1980 and 2010 were Sweden and Switzerland, which each had lower than average GDP growth. Canada and Australia, which saw the strongest GDP growth, showed very little aggregate EPS growth. Why? A big reason is dilution. Canada and Australia saw strong growth from their commodity producing sectors, but that growth came from massive investment, which was funded by diluting shareholders. Switzerland and Sweden did not invest as much and did not dilute their shareholders, leaving shareholders better off despite lower economic growth.

Where all of this gets confusing is that the relationship between earnings per share growth and GDP growth is quite different in the shorter term. If you could accurately predict the next three years of GDP growth, this would be decently helpful for investment purposes as the fastest 20% of growers in the developed world outperform by 2.6% annualized over that three-year period, while the slowest growers underperform by 1.3%. Why does it work in the short term, but not the long term? In the shorter term, GDP growth and earnings are positively correlated. It’s not as strong a relationship as you might think, at 0.32 on average across the developed countries, but it is at least the right sign. In the shorter term, strong GDP growth is associated with cyclical widening of profit margins, whereas long-term growth does not have a similar impact. Where all this gets a bit more confusing is that it almost certainly isn’t GDP growth per se that is most correlated with EPS growth, but GDP growth surprise. Profit margins tend to expand when sales grow faster than what is built into corporate output plans, and they fall when sales growth disappoints relative to plan. Unfortunately we don’t have good history on three-year GDP forecasts across countries, but we can come up with at least a simple proxy of expected GDP growth based on trailing GDP growth and look at the difference between that and actual subsequent growth. The correlation with earnings growth rises from 0.32 to 0.44. The relationship with performance improves as well, with the best 20% of GDP surprise outperforming by 2.9% over the period and the worst 20% underperforming by 2.7%.”

There’s even more to the story than this. For instance, many lesser developed countries aren’t nearly as shareholder and corporate friendly as the USA and many developed countries are so their stock markets just don’t behave all that well. But there’s a more important reason why people often focus on economic growth and how it translates to the markets – tail risk events tend to coincide with economic contractions.

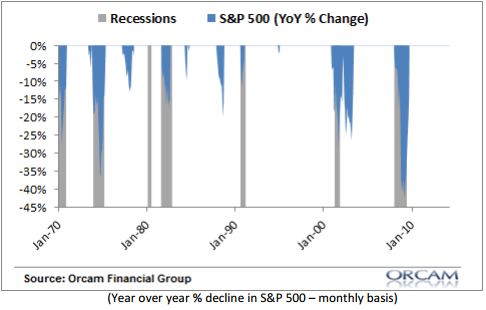

If we look at the history of the US stock market we find that the most devastating tail risk events tend to coincide with recessions. This makes sense. Stocks will gyrate for various reasons inside of a bull market and they tend to be in a bull market roughly 80% of the time. So you’ll often find a declining stock market inside of an economic expansion and a secular bull market. But what we know is that the truly devastating downturns in the stock market just about always occur inside of recessions:

Recessions aren’t just devastating for the broader economy. They also devastate the financial markets. It’s important to remember that the financial markets aren’t the same thing as the economy. But that doesn’t mean it’s irrational to focus on economic data and other operational details. In fact, a better understanding of these points could be the difference between good and bad asset allocation.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.