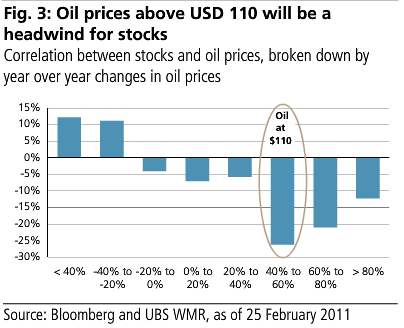

I’ve recently discussed the impact of rising oil and gas prices on the real economy, but what about the equity market? When will the markets begin to substantially worry about rising oil prices? According to UBS, with Brent crude at $116+ we are already beyond the point where rising oil prices are becoming a serious concern. Although they note these higher prices are likely to put a strain on consumers the prices increases are not yet at levels that change their long-term bullish outlook: (via Hedge Analyst):

“How high can oil prices rise before price increases become a significant headwind for equity markets? Looking at the historical record, as shown in figure 3, equity markets have a fairly negative correlation with y-o-y changes in oil prices once price increases exceed 40%. That means that oil prices above USD $110 – the level that translates into a 40% y-o-y increase – will begin to weigh on equity markets. We are very close to this threshold, and Brent prices are actually right at this threshold….This recent spike in prices is significant but not nearly as large as the oil shocks of the 1970s or the spike in prices witnessed during the first Gulf War or in summer of 2008. So while the current level of prices is a concern, they are not yet high enough to alter our constructive view on equity markets and our year-end target for the S&P 500 of 1350.”

Source: UBS

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.