Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. “

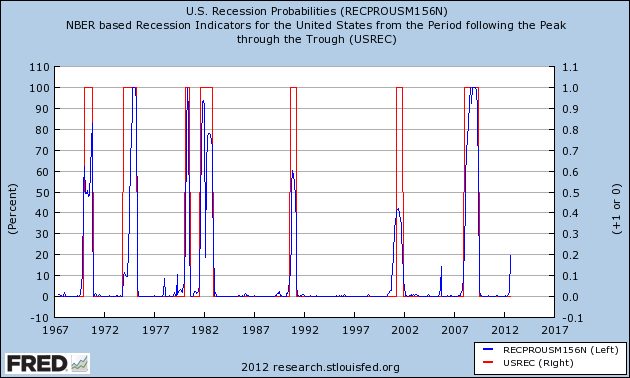

What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index.

Interestingly, I still don’t see recession in my internal indicators. Those indicators have been right for a long time now (in the face of some very public recession predictions by reputable people). So I am afraid when my internal indicators point to “no recession” when an indicator like this clearly puts that opinion in the “this time is different” category….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.