Here are some things I think I am thinking about.

1) No, Rand Paul would not have profited from a US government default. Here is a strange piece in the Nation claiming that Rand Paul would have profited from a US government default during the debt ceiling discussions last year. The author writes:

According to personal financial disclosure forms, as of November 14, 2014, the Kentucky senator had between $1,001 and $15,000 invested in ProFunds’ Rising Rates Opportunity Fund Investor Class, or RRPIX for short. According to the fund’s website, RRPIX allows investors to “seek potential profits from Treasury price declines when interest rates increase.”

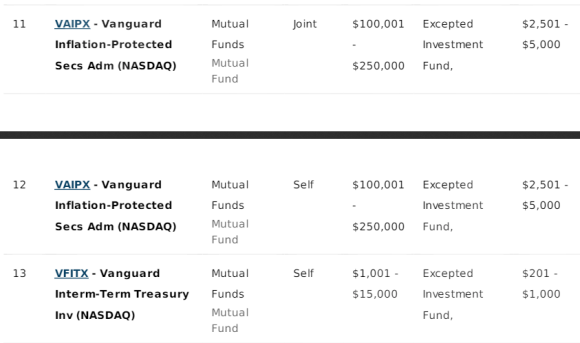

Gulp. That sounds pretty bad. How could a Congressman own a fund that would benefit from rising interest rates and then possibly contribute to the increasing likelihood of a default? It gets worse too. If you look at Paul’s 2014 disclosure you’ll notice that he also owns an inverse long bond fund (ticker: RYJUX) in the amount of $1,000-$15,000.¹ But then you scroll through the rest of the disclosure and something strange jumps out. Rand Paul is HEAVILY invested in US Government TIPS, T-bonds, Notes and Bills. In fact, his long positions in these holdings dramatically outweigh those short positions. For instance, he owns $200K-$500K of VAIPX alone:

Rand Paul’s portfolio isn’t at all constructed to benefit from a US government default because he’s net long US government bonds. By a wide margin. This isn’t a case of nefarious political insider trading. It’s just a case of poor asset allocation.

2) Bill McBride asked a good question at Calculated Risk – How Large Will the First Rate Hike be? That’s an interesting one because of the range of the Fed Funds Rate today. The Fed is paying interest on excess reserves (IOER) at 0.25%. This allows the Fed to expand its balance sheet without driving the overnight rate to 0% (because normally banks would lend their excess reserves to one another until the rate is driven to 0% since they can’t, in the aggregate, get rid of reserves).² So, the Fed sets a floor by paying an interest rate on reserves. The problem is, there’s some residual downward pressure due to the fact that some entities (like the GSEs) don’t get paid IOER. This drives the rate down at times below the 0.25% IOER rate. Today, that rate is about 0.14%.³ They’re attempting to rectify this with the reverse repo operation, but it’s proving to be an imprecise operation.

So, here’s what they have to do. The day’s of setting a target RATE are likely over. Instead, we’re likely moving into the era of a target RANGE. So, today, the Fed is at 0-0.25% on their target range. I think they’ll move slowly and methodically given the turmoil abroad and the continuing uncertainty in the US economy. And so any rate hike would likely be an increase in the target range to 0.25%-0.5%.

That’s my best guess anyhow.

3) It’s the little things that often make the biggest differences. I am a data nerd at heart. Yes, I have lots of opinions, but at the end of the day I work from things in a very mechanical fashion. And data makes up the building blocks of our reality. As a baseball fan I’ve always been fascinated by the quantity of statistics available. When I was 10 years old I was literally doing SabreMetrics before anyone knew what it was. I had created an entire system of statistical analysis in order to find out who was the best player of all time. My working theory was that On Base Percentage, Slugging Percentage and Runs Scored were the only stats that really mattered. After all, the goal is to score runs and the players who get on base (no matter how) and cover more of those bases increase the odds of scoring. Home Runs and Batting Average and RBIs are far more meaningless than most think. And by this measure, I had constructed a model that said Lou Gehrig and Ted Williams were rough equivalents.

Of course, scoring is only half the battle. Baseball games aren’t really won as much as they’re lost. That is, it’s the defenders that make a much bigger impact on the game. The pro skill levels are so high that the games are determined more by strategy mistakes and actual mistakes than by pure skill level differences. We all know that Mike Trout is a tremendous inside and low ball hitter (well, you probably didn’t know that, but real nerds do). So, the way to lose an at-bat to Mike Trout is to pitch to his strengths OR make a mistake that skilled players are superior at taking advantage of. Interestingly, relief pitchers have a disproportionate impact on the outcome of games in this area. That is, they tend to make more mistakes and give up more runs per pitch than starters. So these players, who don’t own the spotlight by any means, often have a huge impact on the game.

I was thinking about all of this after the Washington Nationals (my hometown team) moved to pick up Jonathan Papelbon. This caused a stir in the clubhouse because Drew Storen, who has been outstanding this year, will be bumped from the closer position and into a set-up role. That might sound like a demotion, but in my view it’s really not. The reason why is because the middle inning guys are often disproportionately important relative to the starters and the players who get all the statistical spotlight (via Wins, Saves, etc). For the Nationals this has been a hugely important point. Their relievers lose more games per inning pitched than their starters do. So, Drew Storen could become the most important player in the clubhouse through what looks like a demotion.

So, one could argue that Holds (basically, maintaining the game at the defensive score in which you entered the game) is just as important as Wins and Saves. But this little known statistic gets no love because it has the appearance of not determining the outcome of the games (which is often totally untrue!). What this shows is that it’s often the little things that make the biggest impact. Our minds want to focus on the big glamorous outcomes that appear to be the most important. But this is just behavioral biases at work. We think the games are decided by the power pitchers and the guys who put up all the big numbers that we think are important. Meanwhile, it’s the guys doing the overlooked dirty work that can often decide the outcome of the games.

Sources:

¹ – Rand Paul Personal Financial Disclosure (2014), Legistorm

² – Why did the Federal Reserve start paying interest on reserve balances held on deposit at the Fed?, SF Fed

³ – Statistics on overnight trading in the federal funds market, NY FEd

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.