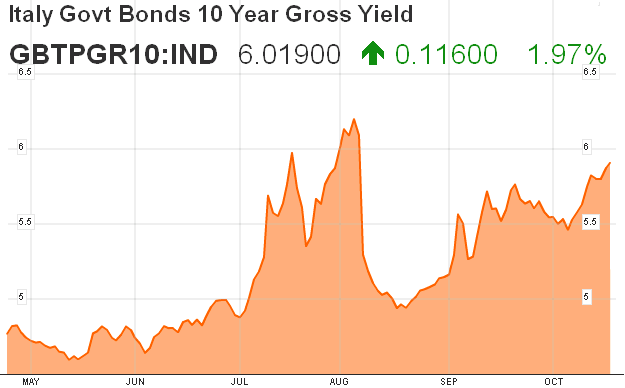

This whole crisis is playing out according to plan so far. The current plan (EFSF) and ECB action does not go far enough in keeping market participants from fearing periphery debt. So, we’re seeing Greece play out all over again in Italy. The ECB won’t commit to open ended QE (as in setting the Italian rate) so we’re seeing the rates continue to surge as market participants realize that Italy’s budget woes are not going to get resolved via fiscal austerity.

As I’ve mentioned on several past occasions, this is the indicator to keep an eye on. If the Italian 10 year surges over 7% (the so-called breaking point for their fiscal situation), then the whole game gets kicked to a new level. The ECB can intervene as they did back in August, but the market will continue to push the envelope as they realize the ECB is only a loose buyer of the bonds. A 7% 10 year on Italian bonds might just be the trigger point for E-bonds? Either way, it’s hard for me to imagine that we’re not going to see a situation in the coming months where the markets don’t force Europe into some sort of fiscal action on the sovereigns themselves.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.