When the Fed initiated QE2 they had visions of lower interest rates in mind. This would result from “portfolio rebalancing” and these lower borrowing costs would lead to higher economic activity as businesses took advantage of the low rates to invest in their businesses. The St Louis Fed recently described this as one of the primary goals of QE:

“As prices increase, interest rates fall. As interest rates fall, the cost to businesses for financing capital investments, such as new equipment, decreases. Over time, new business investments should bolster economic activity, create new jobs, and reduce the unemployment rate.”

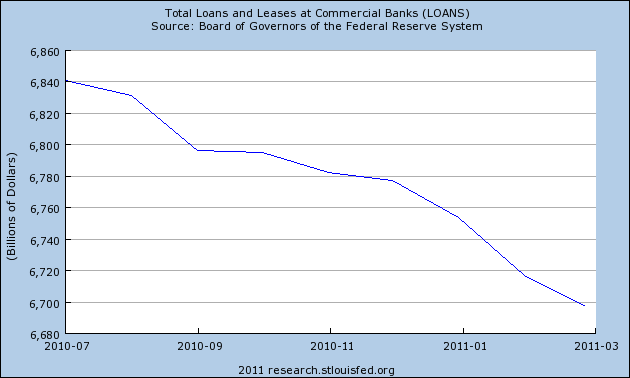

Of course, that’s not exactly how things played out. While the academics like to point to real interest rates as proof of success of QE, the real proof is in the pudding. And the pudding doesn’t taste so good. Total borrowing at commercial banks has continued its steady descent downward. There has been a net decline in total borrowing since QE2 began!

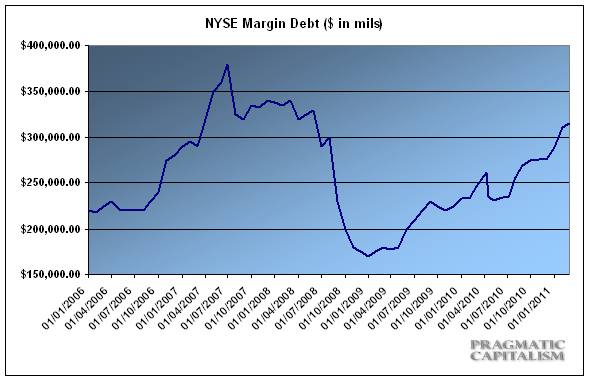

But what QE2 has done is spark a mania in speculation. And according to the NYSE’s margin data there is near record borrowing occurring. According to the March data margin debt is quickly approaching its all-time highs. As I noted last week, this surge in borrowing is not a sign that QE is “working”, but rather, a sign that it is only fueling the very same sort of imbalances and unproductive economic activity that got us into this crisis in the first place.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.