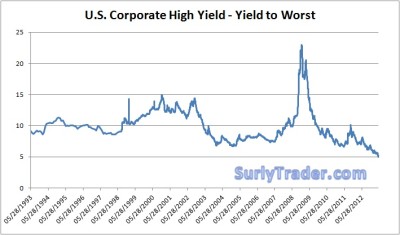

More interesting commentary on the fixed income markets and high yield bonds. This time from our friends over at Surly Trader:

“The average annual credit loss in high yield bond portfolios was 2.65% between 1992 and 2011. During that same time period, your average yield for taking that credit risk was 10.25% and your average option adjusted spread was 5.7% . Today, that total yield has dropped to 4.96%.

At 4.96% you are picking up 4.04% above a comparable tenor in US treasuries. With a 2.65% average credit loss, you are expecting a 1.39% risk premium for taking on junk credit risk if we experience historical average credit losses. Do not worry though, because volatility has been removed from all asset classes.”

High Yield – The New Risk Free Asset Class

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.