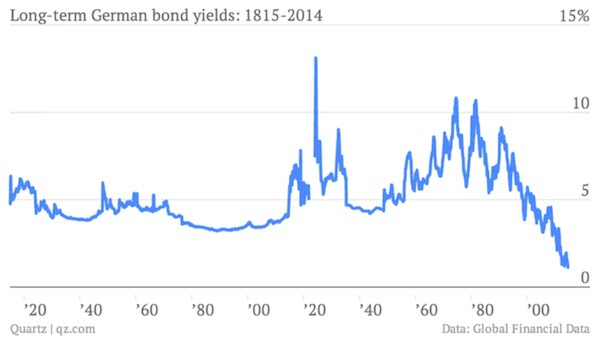

Here’s some perspective for you on the state of the European economy. German bond yields are at unprecedented nominal levels (via John Mauldin):

While it should surprise no one, German long-term bond yields are at historic lows. I recall reading that Spanish bond yields are lower now than they have been at any other time in their history. I actually applaud the Spanish government for issuing 50-year bonds at 4%. I can almost guarantee you the day will come when Spain looks back at those 4% bonds with fondness. (I assume that the buyers are pension funds or insurance companies engaged in a desperate search for yield. I guess the extra 2% over a ten-year bond looks attractive … at least in the short term.)

And finally, let’s really widen our time horizon on German yields:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Geoff

That’s a great long term chart of German bond yields, but I wouldn’t be surprised to see them go to 0.50% like in Japan.

John Daschbach

However, comparing yields on older bonds in a sovereign currency with newer ones in Euro’s is somewhat of an apples to oranges comparison. There is a plausible model which argues that deflation is an inherent tendency of a developed economy without increased fiscal activity. While the ECB, along with the Fed, makes comments about the need for more fiscal action, the political culture thinks otherwise. The market appears to be thinking that deflationary pressures are likely to persist. If I understand Mauldin, he appears to think high inflation will return. The market appears to think otherwise.

me

So if everyone’s bonds are at this low level across the world, how can central banks increase rates? Wouldn’t that bankrupt bond holders as their bonds are locked in for that many years at the lower rate? Does this mean there’s no real way for anyone to raise rates?

John Daschbach

How much can central banks change long rates? The data would suggest not very much. Historically short rates have been pretty tightly pegged to the Fed Funds Rate (e.g. a 3mo T is usually very close to this) However, tt’s hard to rationalize an inverted yield curve if central banks had a major impact on long rates. Yet we have had a number of inverted yield curves.

It doesn’t bankrupt the bond holders if rates rise. If you sell you roughly get the TVM for the remaining period at the interest rate of the comparable remaining period instrument. So there is a loss of principle, but it doesn’t bankrupt you. If hold to maturity you get back the face value and your stream of coupons is lower in value than current bonds. Again this doesn’t bankrupt you.

Even though the markets are not perfectly efficient, they are not completely random either. The market sets the price of almost all assets. Theoretically the Fed could raise or lower Tsy yields if the market thinks the Fed policy is stable. If the Fed holds short rates at R(t>0) > R(t=0) and the market trusts that the Fed will not lower this then certainly that puts a floor on the yield curve (it won’t invert). But it’s never done this so the markets figure it’s temporary. Similarly, the Fed could buy almost all the supply of Tsy which should lower rates. But again, the market has to think the Fed will continue on this path.

If the market thinks the Fed responds in predictable ways given inflation, growth, and employment trends then it’s impact is not going to be that large.

Willy1964

There’s a good reason why both spanish & german rates are so low. Even lower than US rates. Germany, Spain & euro zone, no longer have a Current Account Deficit (unlike the US) and that’s rewarded with lower rates.