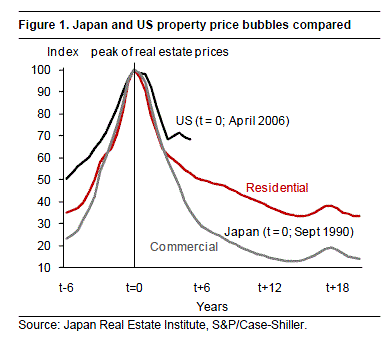

I’ve often compared Japan’s two decade malaise to the current recession occurring in the USA. I’ve pointed out a few distinct differences though. First, this is a household balance sheet recession in the USA whereas Japan suffered from a business balance sheet recession. Second, the USA has been much faster to respond to the crisis. And finally, the USA is not suffering from the double whammy that is an equity bubble AND a real estate bubble on top of one another. Instead, the USA has had their dual bubbles spread out over an entire decade. For these reasons, I think it’s reasonable to argue that the aftermath in the USA is not only likely to be shorter, but less severe.

In a recent story, FT Alphaville cited a Nomura research report which elaborates on this thinking. Remember, the balance sheet recession in the USA is largely a real estate phenomenon – not entirely, but largely. So, it’s no longer “so goes GM, so goes the USA”. It’s “so goes housing, so goes the USA” (generally speaking). Nomura points out a very important distinction between Japan and the USA:

“In the second half of the 1980s, land price fever gripped the Japanese archipelago: residential land prices in the six major urban areas rose by 169% in the five years before they peaked in Q3 1990 and fell by 66.5% before bottoming in Q3 2005; commercial land prices in the six major urban areas rose by 275% in the five years before they peaked in Q3 1990 and fell by 87.2% before bottoming in Q3 2004. In contrast, the Case-Shiller Composite-20 home price index rose by “only” 78% in the five years before it peaked in April 2006 and fell by “only” 31.8% before bottoming five years later.”

So, in terms of the ways we like to think about bubbles, I would argue that the disequilibrium in the US housing bubble was less extreme, therefore, the aftermath should be expected to be less extreme. I guess that’s some consolation in this horrid economic environment. Less bad is good, right?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.