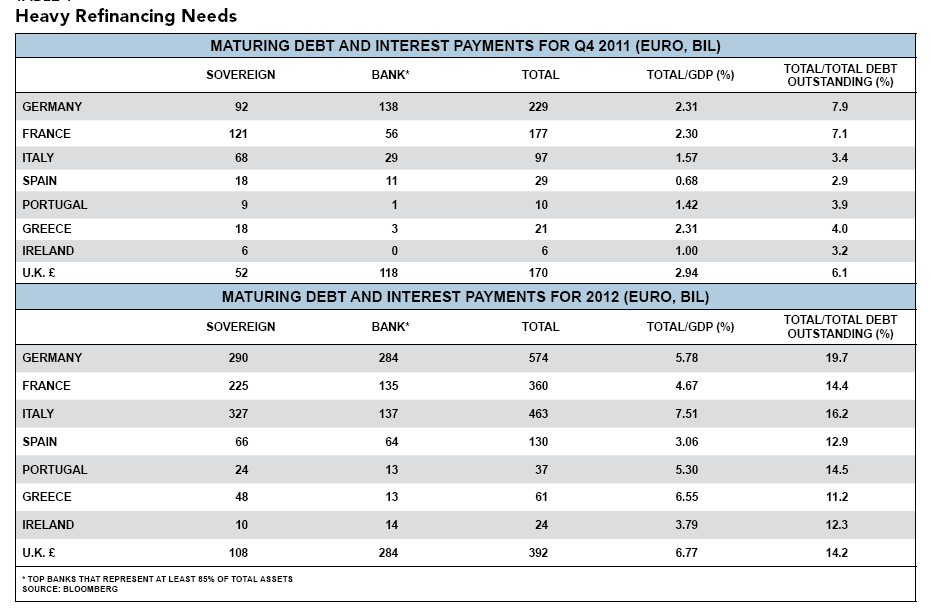

If you wanted a single picture that summed up the inevitable nightmarish outcome of the EMU crisis, this is the one (big thanks to my friend Martin at Macronomics). The data below shows the refinancing needs for the whole of Europe’s sovereigns and banks. Martin writes:

“To put it simply there is no way Italy can refinance without the ECB acting as lender of last resort. The EFSF has not enough firepower to support both peripherals and the bank recapitalization process. It is either one or the other. Given the issue of circularity and the need for economic growth to break debt dynamics, I do not see the solvency issue resolved without the ECB stepping in. The big question is, would Germany allow the ECB to alter its DNA given it would contravene the Lisbon treaty, if it starts intervening massively? I have some doubt about it, and it is a scary prospect. So far the Bundestag and German Constitutional court have stepped in to rein in the expansion of the EFSF, because they do not want to betray German people. Either they know it is not the solution and are buying some time to allow for more integration within Europe and using it as a bargaining tool to force Greece and others to concede their independance somewhat in exchange of stronger support, or, the game is for Germany to buy some time and leave and join force with Austria, Finland, the Netherlands, and leave peripherals on their own.

Banks refinancing needs for 2012 are around 950 billion USD according to Bloomberg.

So yes, the math is clear. With our CPDO/EFSF it just doesn’t work.”

As I keep repeating – Greece is a sideshow by now. This crisis will linger and likely worsen in 2012. And the risk now is that it will spillover into Portugal, Spain and Italy. A bazooka lurks in the form of E-bonds. Will the EMU leaders use it or will the whole thing blow-up before they proactively fix this mess? This week’s developments have me seriously concerned whether Europe can be trusted to work this out together…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.