This analysis by CitiGroup highlights the correlation between earnings and equity markets. Citi claims that equities begin to discount the potential for higher earnings well in advance of the actual trough in EPS. This was most visible in my Expectation Ratio which turned sharply north in early 2009 when I stated:

“The indicator has only just recently become positive again which is telling me that analysts are finally beginning to cut their estimates to realistic levels. The indicator was a little early to the party in 2007 and I presume it will be early again in forecasting a recovery, however, it is a good sign that now is a time when you might want to be dipping your toe in the waters. If you’re young and have a long time horizon you certainly want to be adding to positions.”

Citi is using a similar methodology to highlight their expectations for higher equity prices. Unfortunately, this analysis ignores the fact that analysts are always overly optimistic at peaks and excessively pessimistic at troughs. That is why the EPS estimate in and of itself is relatively useless. It needs to be compared to expectations. The market is likely to discount peaking earnings before Citi’s analysts have even started to change their numbers. So while keeping a tab on future EPS is important it’s equally important to understand that the EPS figure alone is not the only guidepost worth tracking:

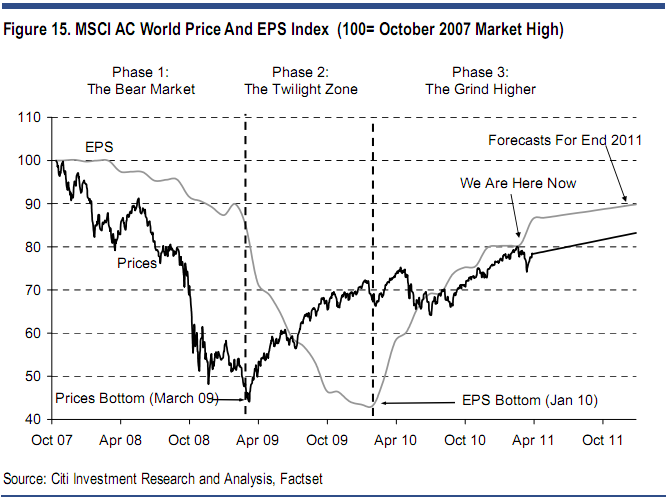

“We have used a consistent framework to map out the progress of the global equity market cycle. Figure 15 shows the benchmark MSCI AC World price index against its EPS index. We use trailing EPS so there will be some reporting lag. Reassuringly, this shows that share prices generally track profits over the long run. But there can be significant divergence along the way.”

“The Twilight Zone begins when share prices bottom out (March 2009 in this cycle). This is usually around 6-9 months before global EPS bottoms out. A combination of cheap valuations, tightening credit spreads, low interest rates and economic green shoots is enough to turn share prices despite continued weakness in earnings. We call it the Twilight Zone because it can be very confusing for fundamental equity investors: share prices rise sharply even as EPS fall sharply.

The Twilight Zone ends and the Grind Higher begins as EPS starts to recover (January 2010 in this cycle). The Grind Higher has traditionally been associated with reasonable, if not spectacular, returns from global equities. This gives EPS a much-needed chance to catch up with share prices.”

Source: CitiGroup

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.